Aston Martin Lagonda Global Holdings PLC (GB:AML) shares rallied today after Jefferies increased its target price while also upgrading the rating to Buy from Hold. The bank is optimistic that models like DB12, Vantage, and the new DBS will drive better volumes and margins for the company.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Post-upgrade, shares gained 5.35% in trading at the time of writing. The company’s stock has taken off in 2023 and gained 118% so far. Over the last year, the firm has captured significant interest from both investors and analysts, driven by noteworthy developments such as impressive earnings, positive guidance, new investments, upcoming product launches, and more.

Aston Martin Lagonda is a UK-based manufacturing company specializing in luxury sports cars. The company has well-known models like DBS, DBX, Vantage, Aston Martin Valkyrie, etc. under its portfolio.

Let’s dig deeper.

The Upgrade

Today, analyst Philippe Houchois from Jefferies upgraded his rating on the stock from Hold to Buy. He also raised his price target from 300p to 420p, indicating an upside of 23.7% in the shares. Houchois is mainly bullish on the company due to its net debt position, a renewed emphasis on front-engine cars, and substantial improvements in average selling prices.

After its solid Q2 earnings, he also raised his estimate for fiscal year 2023 revenues by 3% to £1.63 billion with a gross margin of 37.2%. He expects the margin to reach 40% in FY 2024. For 2023, he is also predicting an EBIT loss of £53 million. He added that the recent three capital raises have provided liquidity to the company’s balance sheet.

Prior to this, seven days ago, Henning Cosman from Barclays also reiterated his Buy rating on the stock, forecasting an upside of 17.8%.

What is the Target Share Price for Aston Martin?

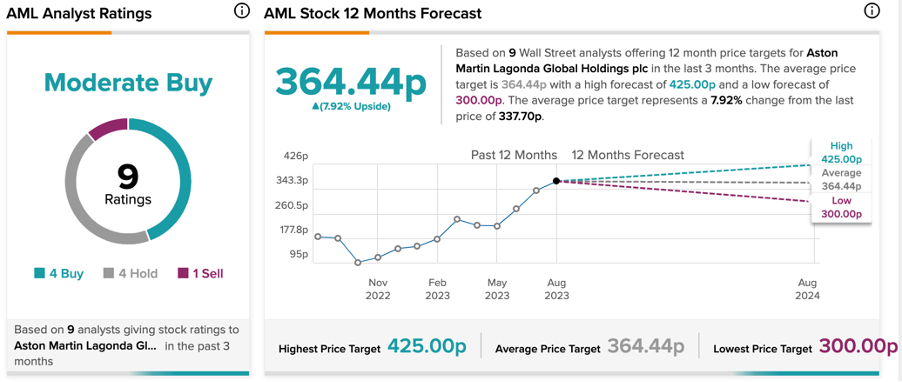

According to TipRanks’ rating consensus, AML stock has a Moderate Buy rating. The projected average price for the stock is 364.44p, indicating an upside of 8% from the current level.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue