Kyle Vogt, the CEO of General Motors’ (NYSE:GM) self-driving unit, Cruise, apologized to Cruise employees for the dismal condition of the unit while also stepping down from his role on Saturday. Cruise’s board accepted Vogt’s resignation on Sunday. Moreover, Vogt confirmed that Cruise will set out a new tender offer enabling employees to sell their shares and dismissed the order to cancel the same set last week.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

A suitable replacement for Vogt hasn’t been announced yet. Mo Elshenawy will take up the president and chief technology officer roles from his current title of executive VP of engineering. In his email to employees, Vogt took full responsibility for Cruise’s current state and said, “There are no excuses, and there is no sugar coating what has happened. We need to double down on safety, transparency, and community engagement.”

Cruise’s employees are awarded Restricted Stock Units (RSUs) as part of their compensation. These RSUs were allowed to be sold to GM and other investors as part of an employee retention scheme. Some employees complained that they could face tax obligations on the stocks if the share sale was scrapped, and hence, Cruise decided to resume the offer.

Is GM a Risky Stock?

Last month, Cruise lost its permit to run its driverless robotaxis in California, followed by a complete stop of robotaxis across the U.S. Early in November, Cruise announced the temporary stoppage of production of robotaxis with the investigation of a driverless robotaxi incident underway. All these occurrences have led to a loss of confidence in the Cruise unit since its official operations began 15 months ago.

The series of incidents at GM’s Cruise unit, the toll from the United Auto Workers (UAW) strike, and stepping back from its electric vehicle ambitions have impacted GM’s stock. Year-to-date, GM stock has lost 16.5%.

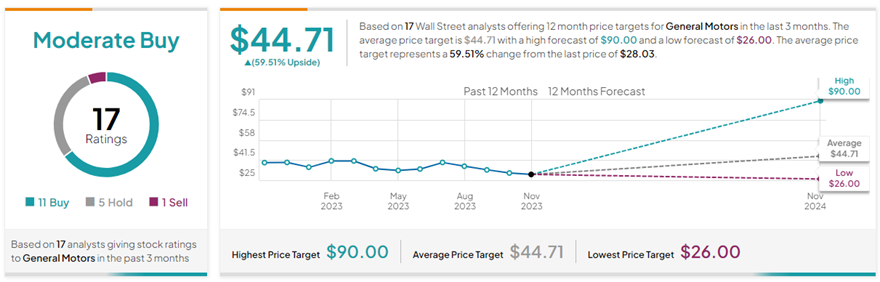

Analysts have a Moderate Buy consensus rating on GM stock. This is based on 11 Buys, five Holds, and one Sell rating. The average General Motors price target of $44.71 implies 59.5% upside potential from current levels.