General Motors (NYSE:GM)-owned unit Cruise’s permit to test and deploy autonomous driverless robotaxis in California was revoked effective immediately on Tuesday, October 24. The California Department of Motor Vehicles (DMV) suspended Cruise’s license in San Francisco following a probe into an incident earlier this month. The DMV concluded that Cruise’s driverless robotaxis were “not safe for the public’s operation” and accused the company of misrepresenting information related to the incident.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

DMV Suspends Cruise’s Permit

The suspension is temporary and the DMV has informed Cruise about the future course to reinstate the permit for its driverless robotaxis. Importantly, the suspension does not include Cruise’s auto-taxis that have a “safety driver” on board to take immediate control of the vehicle. The company has halted operations of the driverless robotaxis following the DMV’s order. At the same time, the Office of Defects Investigation of the National Highway Traffic Safety Administration (NHTSA) is also investigating if Cruise is taking necessary precautions with its autonomous vehicles for pedestrian safety.

In the accident, a pedestrian was first hit by another vehicle and thrown in front of Cruise’s unmanned robotaxi. The autonomous vehicle (AV) did come to a complete halt with the pedestrian trapped beneath it. The AV then attempted to pull over, dragging the pedestrian for another 20 feet. As per the DMV, the company failed to disclose the “pullover maneuver” and only stressed the video showing the collision and the AV’s immediate halt.

Meanwhile, General Motors reported solid Q3FY23 results yesterday, beating revenue and earnings estimates. The Cruise unit reported a net loss of $732 million for the quarter, up from $497 million in the year-ago period.

What is the Prediction for GM Stock?

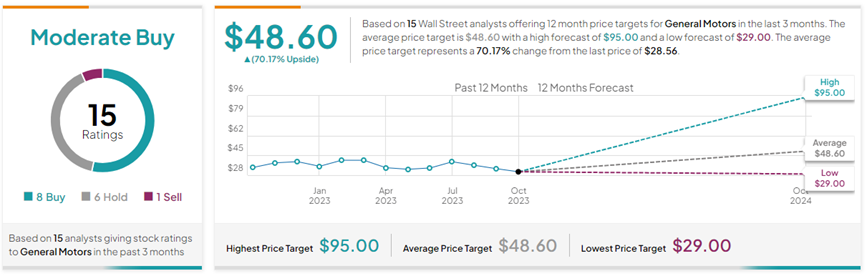

On TipRanks, the average General Motors stock prediction of $48.60 implies 70.2% upside potential from current levels. Further, GM stock has a Moderate Buy consensus rating based on eight Buys, six Holds, and one Sell rating. Year-to-date, GM stock has lost 14.9%.