According to a report published by The Wall Street Journal, Colorado-based Frontier Group Holdings, Inc. (NASDAQ: ULCC) has signed an agreement to acquire budget airline Spirit Airlines Inc. (NYSE: SAVE) in a cash and stock deal worth $2.9 billion.

Frontier will also assume Spirit’s net debt and operating leases, thus taking the total value of the deal to $6.6 billion. The acquisition would lead to the creation of the fifth-largest airline in the U.S., the carriers said.

The President and CEO of Spirit, Ted Christie, said, “This transaction is centered around creating an aggressive ultralow fare competitor to serve our guests even better.”

Once the acquisition is complete, which is expected in the second half of this year, Frontier will hold an around 51.5% stake in the merged company. Moreover, Frontier’s Chairman William Franke will become the Chairman of the combined company.

The companies said that the merger would allow them to boost low-cost service in the Caribbean, Latin America and the U.S. They would also be able to employ 10,000 more people by 2026.

About Frontier Group

Frontier is an ultra-low-cost carrier that offers flights across the U.S. and to select international destinations in Mexico and the Caribbean.

Its shares closed 3.5% up on Monday. The stock gained another 0.8% in after-hours trading to end the day at $12.92.

About Spirit Airlines

Based out of Florida, Spirit offers budget air travel services throughout the U.S., the Caribbean and Latin America.

Following the news on Monday, SAVE stock surged 17.2% to close at $25.46.

Price Target

Based on 3 Buys and 3 Holds, Spirit has a Moderate Buy consensus rating. The average SAVE price target of $29.17 implies 14.6% upside potential from current levels. Shares have lost 14% over the past six months.

Risk Analysis

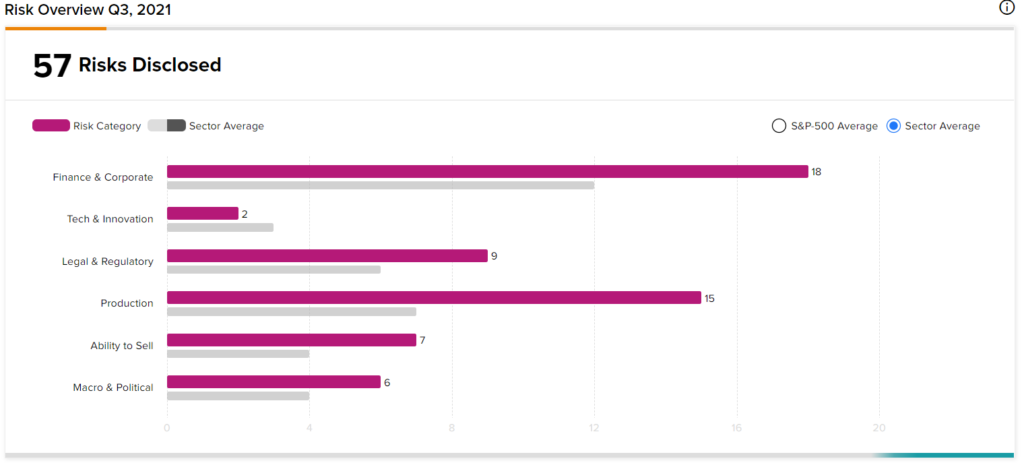

TipRanks’ Risk Factors tool has identified 57 risks for Spirit Airlines. Of these risks, 18 are related to Finance & Corporate and 15 are Production risks.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

RenaissanceRe Rewards Shareholders with Increased Dividend & Buybacks

U.S. CDC Supports Full Approval of Moderna’s Spikevax – Report

Johnson Controls Updates 1 Key Risk Factor