Shares in Fiverr (FVRR) are surging 6% in pre-market trading as the freelance services platform continues to reap the rewards from the global shift towards digital transformation and remote work.

Specifically, Q3 Non-GAAP EPS of $0.12 beat Street estimates by $0.06 while GAAP EPS of -$0.01 beat by $0.04. Meanwhile revenue of $52.35M soared by an impressive 87.8% year-over-year and topped Street expectations by $3.49M.

Active buyers grew 37% year-over-year with net additions of over 310,000 as strong trends from both organic and paid channels continued, with Promoted Gigs monthly active sellers rising to 5,000+ in Q3’20 from just under 200 in Q2’20.

Also of note, spend per buyer as of September 30, 2020, reached $195, an increase of 20% year over year. GAAP gross margin in the third quarter was 83.4 and Non-GAAP gross margin came in at 84.4%.

Looking forward, FVRR issued guidance for the full year with revenue of $186M-187M and Adjusted EBITDA of $8.5M-9M.

“The strong momentum seen in Q2 carried into Q3 and we delivered accelerated topline growth of 88% y/y and Adjusted EBITDA margin of 8.0% in Q3’20” cheered Fiverr CEO Micha Kaufman.

“We continue to see sustainable trends in businesses upping their investments into digital transformation and their increasing willingness to adopt a remote and flexible workforce,” Kaufman added.

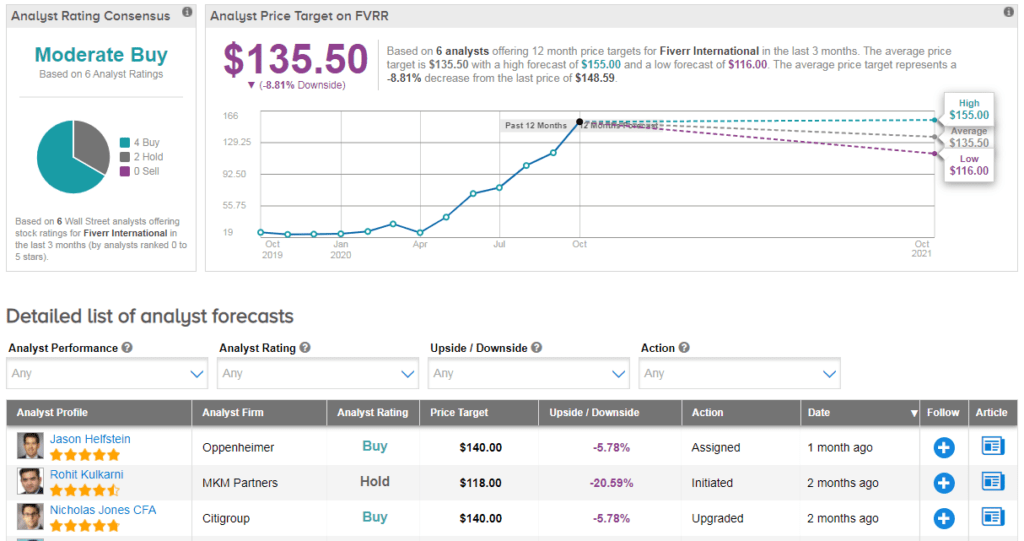

Fiverr has exploded by over 530% on a year-to-date basis, and the stock scores a cautiously optimistic Moderate Buy Street consensus. That’s with 4 buy ratings vs 2 hold ratings.

Due to the recent rally, the average analyst price target of $136 now indicates shares could pull back from current levels.

Oppenheimer’s Jason Helfstein has a buy rating on the stock and $140 price target. “As the leading marketplace for freelance labor, we believe Fiverr is well positioned to capitalize on a shift in the labor market toward more independently-driven opportunities made possible through digitization” the analyst explained.

Estimated at a $100B market, only 3% of freelancing jobs are completed online and only 25% of those who identify as a freelancer have ever used an online platform, Helfstein noted. (See FVRR stock analysis on TipRanks)

Related News:

Shopify Inks Social Commerce Partnership With TikTok

NCR’s 3Q Sales Dive 11% As Covid-19 Hurts Hardware Business

Microsoft Down After-Hours Despite Very Strong Earnings Beat