NCR Corp.’s 3Q revenues fell 11% to $1.59 billion year-over-year dragged down by a 26% decline in hardware sales. However, revenues of the ATM (automated teller machine) and POS (Point-Of-Sale) hardware and software solution provider came ahead of analysts’ estimates of $1.55 billion.

NCR’s (NCR) ATM hardware sales plunged 40% as the COVID-19 pandemic impacted ATM installation activities. Moreover, its SCO/POS (Self-Checkout/Point-Of-Sale) hardware sales shrank 6% on a year-on-year basis.

The company’s 3Q adjusted EPS decreased by 26% to $0.54 year-on-year but came ahead of the Street estimates of $0.36.

NCR’s CEO Michael Hayford said, “Our third quarter performance reflects solid execution of our strategy and the resiliency of our solutions in a difficult operating environment that continues to be impacted by COVID-19.” He further noted, “Looking ahead, we still face a challenging operating environment but we remain confident in our ability to execute our strategy and grow recurring revenue, drive cash flow generation and expand margins.” (See NCR stock analysis on TipRanks).

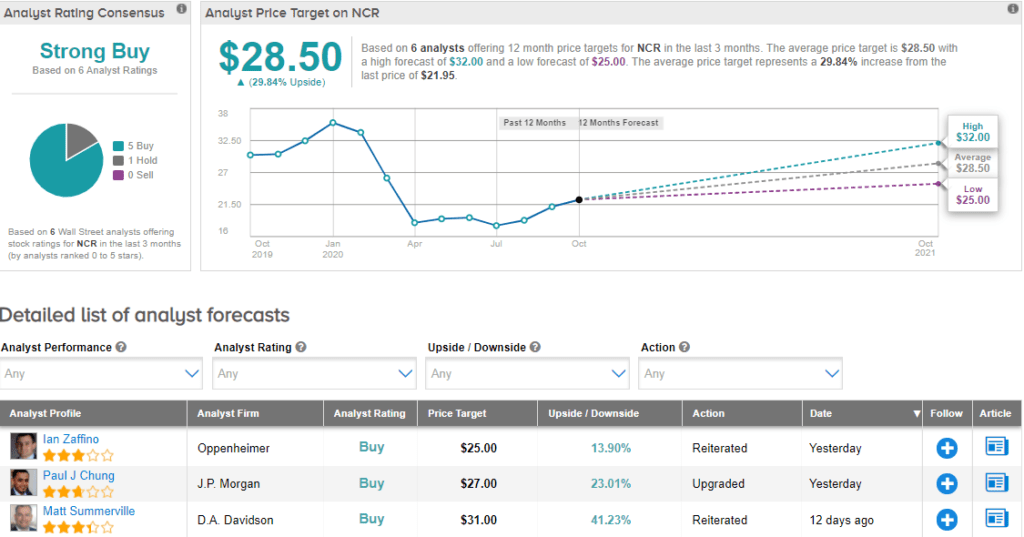

Ahead of its earnings release, J.P. Morgan analyst Paul J Chung upgraded the stock to Buy from Hold and raised the price target to $27 (23% upside potential) from $21. Chung is encouraged by NCR’s margin structure and free cash flow outlook. The analyst sees modest growth in ATMs per branch and forecasts a steady fundamental recovery over the next 6-12 months.

Currently, the Street is bullish on the stock. The Strong Buy analyst consensus is based on 5 Buys versus 1 Hold. With shares down nearly 38% year-to-date, the average price target of $28.50 implies upside potential of almost 30% to current levels.

Related News:

F5 Networks’ 1Q Outlook Beats The Street; Shares Gain 4.3%

Varonis Beats 3Q Profit Estimates; Shares Spike 9%

NXP Sees Higher 4Q Sales; Shares Rise