From a bird’s-eye view, the case against discount retailer Five Below (NASDAQ:FIVE) – which, as its name suggests, specializes in products priced up to $5 – seems clear. Following a disappointing earnings report, investors quickly rushed for the exits. However, a discount retail business model is arguably what’s most needed during a tricky economic environment. Therefore, I am bullish on FIVE stock as a long-term investment opportunity.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

FIVE Stock Suffers an Earnings Fail

To be upfront, it came as no surprise that FIVE stock incurred a sharp loss last week. That’s usually what happens when public companies miss the mark. As TipRanks reporter Vince Condarcuri noted, Five Below shares sank during Wednesday’s after-hours trading session. The retailer posted a 2.8% lift in comparable sales, along with earnings per share of $3.65. However, both metrics fell short of analysts’ expectations.

During the earnings conference call, Five Below’s CEO Joel D. Anderson stated that while strong sales helped boost profitability, the company suffered an unexpected shrink or loss of inventory. Unfortunately, this situation pushed earnings to the lower end of management’s guidance. Moving forward, the company will take measures to mitigate the inventory loss.

Condarcuri wrote that for the upcoming fiscal year, Five Below “anticipates comparable sales growth ranging from 0% to 3%, below the 2.2% consensus, and forecasts an EPS between $5.71 and $6.22. For reference, analysts were expecting an EPS of $6.48.” Naturally, investors were disappointed with the downgraded guidance, leading to more volatility for FIVE stock.

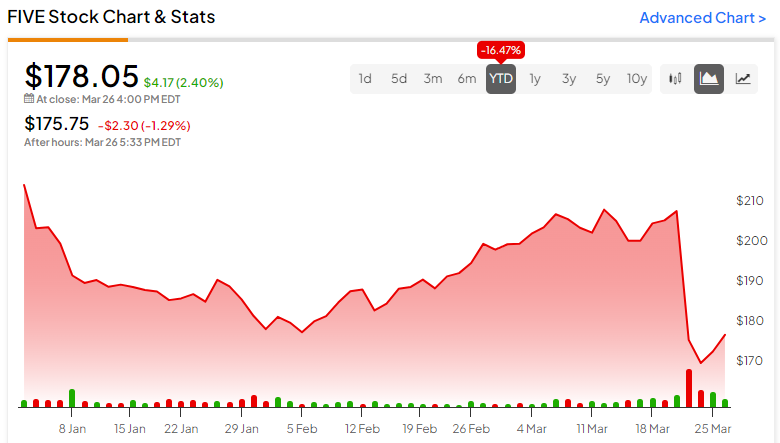

Conspicuously, Five Below already was looking shaky this year, getting off to an inauspicious start. The Q4 print exacerbates the rough performance, with FIVE stock down almost 21% year-to-date. Still, it might be premature to give up on the discount specialist.

It’s important to consider the broader context. In the trailing three quarters prior to Q4, Five Below generated an average positive earnings surprise of 5.27%. Stated differently, despite the challenges impacting the consumer economy, Five Below has been consistently producing positive results. One disappointing print doesn’t change the entire narrative.

Five Below Knows What It Needs to Do

Here’s another piece of context. For most of last year, big-box retailer Target (NYSE:TGT) suffered a sharp erosion in market value. Sadly, organized retail crime (a fancy phrase to describe shoplifting) significantly impacted profitability. At the time, investors were forced to take a tactical approach. The same could be applied to FIVE stock. This correction may be a temporary response to a current problem that will be addressed.

One of the negative contributors to Five Below’s recent profitability woes centered on theft. In response, the company is backing away from self-checkout lanes for store locations that suffer from greater theft rates. Combined with adding more staff and implementing greater security measures, management has a clear plan to curb the shrinkage problem.

Additionally, FIVE stock could organically benefit from the current economic environment. Yes, circumstances have improved significantly since the worst days of the COVID-19 crisis. However, that doesn’t mean that society has moved past the pandemic without any bruises.

Even this year, technology firms have laid off workers. These are high-paying occupations that often require relevant advanced degrees and/or certifications. So, as the pink slips start flying, Five Below’s total addressable market should increase. Therefore, the red ink in FIVE stock – while admittedly ugly – should turn out to be an upside opportunity in the long run.

If that wasn’t a clear enough signal, Americans have incurred a record amount of credit card debt. On top of that, delinquencies on this collective plastic liability have started to rise. Translation? People need discounts. They can’t afford luxury discretionary items.

Finally, FIVE stock enjoys an image advantage over literal dollar stores. Essentially, because Five Below is a cut above the bottom-barrel items found in “pure-play” dollar stores, the brand appeals to a wider consumer audience. So, it’s not yet time to hit the panic button.

A Relatively Undervalued Stock

At the moment, FIVE stock trades at a forward earnings multiple of near 28x and a trailing-year multiple of 32.9x. In contrast, the specialty retail sector features an average trailing-year earnings multiple of 18.2x. By the numbers, Five Below isn’t cheap. Ironically, it’s trading at a premium.

However, in the quarter ending July 31, 2023, FIVE stock ran a forward multiple of 37.45x. With the recent volatility, the valuation has come down. It’s not outright undervalued against the underlying industry. Still, it’s relatively discounted, and it’s a trustworthy valuation.

Here’s the deal. When Five Below was beating its EPS targets (between Q1 and Q3 last year), FIVE’s forward price-earnings ratio stood at nearly 33x. The argument is that the company can get back to its winning ways. Subsequently, the aforementioned 28x ratio is a contextually undervalued signal.

Is FIVE Stock a Buy, According to Analysts?

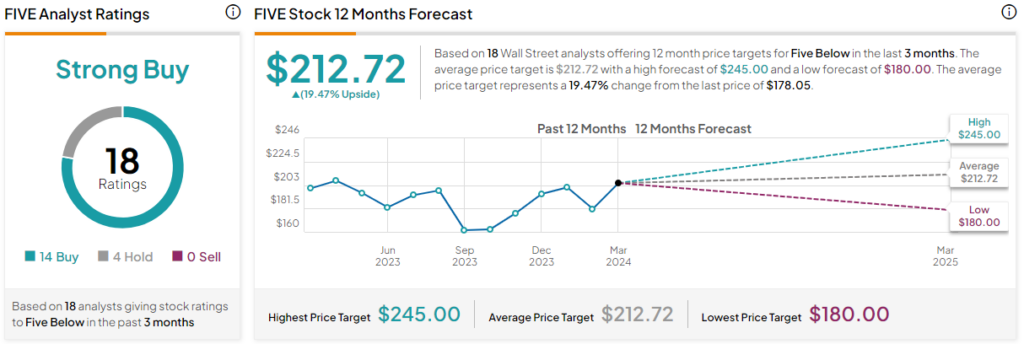

Turning to Wall Street, FIVE stock has a Strong Buy consensus rating based on 14 Buys, four Holds, and zero Sell ratings. The average FIVE stock price target is $212.72, implying 19.5% upside potential.

The Takeaway: FIVE Stock Is Only Incurring a Temporary Downdraft

With Five Below posting a disappointing Q4 earnings print, it was inevitable that FIVE stock would take a hit. However, the magnitude of the downside may be overdone. Management has a plan to address the key concern of inventory losses. Also, the security appears undervalued based on the company’s recent history of outperformance amid challenging economic circumstances.