First Citizens BancShares (NASDAQ:FCNCA) has filed a lawsuit accusing U.K. banker HSBC Holdings (NYSE:HSBC) of scooping up senior talent from its recently acquired bank, Silicon Valley Bank (SVB). The lawsuit claims more than $1 billion in damages. While First Citizens owns a majority of SVB’s U.S. deposits and loans, HSBC UK Bank also took over Silicon Valley Bank UK Limited for GBP 1.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

First Citizens alleges that HSBC strategized with senior executive David Sabow of the now-defunct SVB to poach a group of roughly 40 bankers for HSBC. FCNCA had been betting on SVB’s lucrative tech clients to grow its business. The exodus of these bankers would mean stealing proprietary information on clients and their relationships with them. Sabow was the first to flee to HSBC after SVB’s takeover by First Citizens.

The lawsuit pointed to a scheme titled “Project Colony,” which proposed luring the bankers and leveraging them to generate profits of roughly $66 million in year one. The profits would then be steadily increased to reach $1.3 billion in the fifth year. The project aimed to first bring six senior bankers on board, who would then drag along other employees by luring them with “great fortune.”

And accordingly, the complaint said that two weeks after First Citizens bought SVB, 42 employees resigned within a span of 30 minutes on April 9, Easter Sunday. These resignations have drained some of the important talent pool from SVB, and First Citizens alleges that this will hinder its growth plans.

The complaint also stated, “If stable banks are to be [incentivized] to rescue failed banks to restore financial stability, opportunistic competitors and insiders cannot take and replicate the bank’s assets — its highly sensitive confidential, proprietary and trade secret information — before the resolution can be implemented.” Only time will tell if HSBC heeds the complaint and stops further work on “Project Colony,” and whether FCNCA is able to win back the important bankers and pursue its growth prospects.

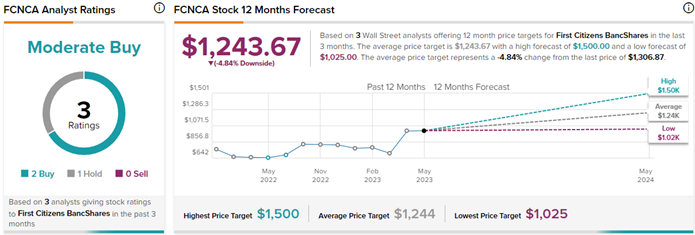

Is FCNCA a Buy or Sell?

On TipRanks, FCNCA has a Moderate Buy consensus rating based on two Buys and one Hold rating. Also, the average First Citizens BancShares price forecast of $1,243.67 implies 4.8% downside potential from current levels. Meanwhile, FCNCA stock has already amassed 74.1% so far this year.