First Citizens BancShares (NASDAQ:FCNCA) reported a significant jump in its first-quarter earnings per share (EPS) to $653.64 compared to $16.67 in Q4 2022, thanks to a $9.8 billion gain from the rescue deal for the failed California-based lender Silicon Valley Bank (SVB). Shares surged 7.5% on Wednesday in reaction to the upbeat results, bringing the year-to-date rise to 55%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, adjusted EPS declined slightly quarter-over-quarter to $20.09 and lagged analysts’ estimate of $22.29.

Meanwhile, net interest income increased 6% sequentially to $850 million in Q1, with SVB contributing $65 million. The bank ended Q1 with deposits worth $140.05 billion, reflecting an increase of $50.6 billion from Q4 2022-end, of which the SVB deal added $49.3 billion. Analysts were expecting deposits of $119 billion.

Commenting on the SVB deal during the earnings call, CEO Frank Holding Jr. said, “This transaction meaningfully boosted our capital base providing us with an even more solid foundation to continue growing profitably while delivering long-term value to our shareholders.”

First Citizens acquired SVB in late March and agreed to buy $72 billion of SVB’s loans at nearly 20% discount. It also assumed $56 billion of SVB’s deposits. The Federal Deposit Insurance Corp. (FDIC) seized SVB on March 10, after the bank’s investments significantly lost their value and depositors withdrew large amounts of money.

It is worth noting that First Citizens’ provision for credit losses spiked to $783 million in Q1, up from $79 million in Q4 2022, mainly due to the SVB deal. Nonetheless, the bank assured that it continues to operate with “solid” capital and liquidity positions despite macro pressures.

Is FCNCA a Good Stock to Buy?

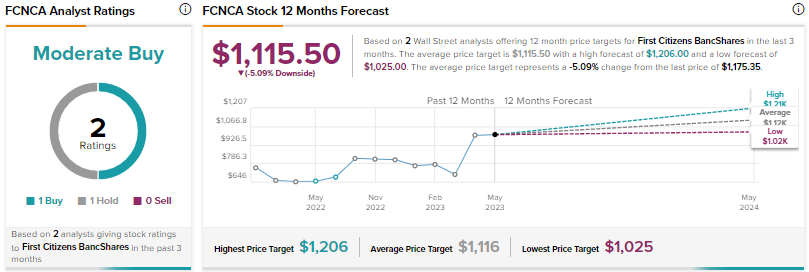

Wall Street’s Moderate Buy consensus rating for First Citizens is based on one Buy and one Hold. The average price target of $1,115.50 suggests a possible downside of 5% following a significant rally so far this year.