Shares of the global platform for luxury fashion, Farfetch Ltd. (FTCH) have declined 63.6% so far this year. FTCH’s recent fourth-quarter performance was a mixed bag with top-line lagging estimates despite registering double-digit growth.

Revenue jumped 23.2% year-over-year to $665.7 million, but missed the Street’s expectations by $7.6 million. Net loss per share at $0.03, came in narrower than analysts’ estimates by $0.05. Notably, the company delivered full-year profitability at the earnings before interest, taxes, depreciation, and amortization (EBITDA) level for the first time on the back of a boost in profit margins and growth in Gross Merchandise Value (GMV).

Management noted the company is on a strong footing for 2022 and is focused on continuing to lead the online fashion industry, grow faster than the competition, and expand profit margins.

With these developments in mind, let us take a look at the changes in FTCH’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Farfetch’s top risk category is Finance & Corporate, contributing 21 of the total 75 risks identified for the stock.

However, in its recent report, the company has added one key risk factor under the Ability to Sell risk category. Compared to a sector average of 6 Ability to Sell risk factors, FTCH’s is at 19.

FTCH highlighted that as a part of its business strategy, it may offer consumers the option to transact via cryptocurrencies, to build or exchange non-fungible tokens (NFTs) or collaborate in the metaverse through new and emerging digital environments.

This pursuit of innovation entails additional risks. These initiatives may not pan out as per expectations. The NFT and metaverse space are uncertain. Cryptocurrencies are not considered legal tenders by most governments, and have seen technical glitches as well as regulatory interventions. If FTCH fails to comply with any government prohibitions, then it may face legal action.

Moreover, fluctuation in the prices of cryptocurrencies or other digital assets that FTCH may hold could lead to volatility in its financial performance.

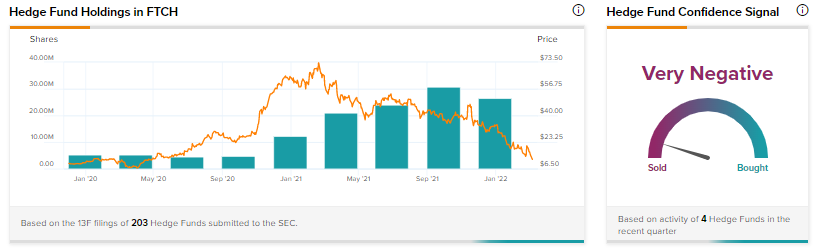

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in Farfetch by 4.2 million shares in the last quarter, indicating a very negative hedge fund confidence signal in the stock based on activities of 4 hedge funds. Notably, Steve Mandel’s Lone Pine Capital has a holding worth ~$817 million in FTCH.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Moderna to Open Enterprise Solutions Hub in Atlanta

Amazon Expects FTC’s Verdict on MGM Acquisition by Mid-March: Report

Snowflake Drops 22% on Surprise Quarterly Loss & Disappointing Guidance