Etsy (NASDAQ:ETSY) continued its descent after reporting a disappointing earnings report, even though the rest of the market rallied on the back of impressive earnings from Nvidia (NASDAQ:NVDA). Etsy seems lost as it struggles to find a path to growth. I have been bearish on this stock for a while, and the latest earnings report reinforced that sentiment. I don’t see any reason to hold onto this stock.

What Caused the Decline?

There wasn’t much of a silver lining in the company’s earnings report. In a previous article where I argued that Etsy was still overvalued despite a 76% fall, I emphasized focusing on changes to the company’s gross merchandise sales.

Sure enough, gross merchandise sales were down by 0.7% year-over-year. That means Etsy, as a whole, generated less business. The company still reported 4.3% year-over-year revenue growth, but that growth came from increasing the costs of buyers and sellers. Etsy Ads also played a role in revenue growth.

The stock trades at a 28 P/E ratio, but a 21% year-over-year net income drop suggests there’s more room for the stock to fall. A few more quarters like this will warrant a valuation closer to eBay (NASDAQ:EBAY) or Target (NYSE:TGT), and Etsy still has a long way to go just to reach Target’s P/E ratio.

Growth Is Dead

Consolidated GMS and revenue “growth” figures indicate that growth isn’t coming back anytime soon — if it ever does. While these numbers tell the story quite well, commentary from management is even more concerning and suggests leadership is content with the current state of affairs. These two statements grabbed my attention:

“The Etsy marketplace’s GMS accelerated during the holiday season, with GMS during Cyber 5 (Thanksgiving through Cyber Monday) up 4% on a year-over-year basis.”

A 4% year-over-year growth rate for the biggest weekend of the year isn’t the type of acceleration I want to see from a company that was once heralded as a top growth stock. However, the following statement is even worse. “Etsy marketplace GMS was $3.6 billion, down 1.4% year-over-year and up 142% on a four-year basis.”

It’s ridiculous to see Etsy still using growth rates from the pandemic to justify poor performance in the present. It would be like Zoom (NASDAQ:ZM) reminding investors of those really great quarters they had when people had no other choice but to do virtual conferences and classes.

I thought we had moved on from this tactic, but it seems like 2020 results will remain a fixture in growth rates because that’s the only way the company can muster something that’s slightly impressive. What are we going to get at the end of 2029? Revenue growth on a 10-year basis?

Etsy’s GMS was also down year-over-year in Q4 2022, so there is a pattern of losing market share.

Guidance Didn’t Help

Etsy is forecasting a low-single-digit year-over-year decline in gross merchandise sales in Q1 2024 and offered insulting revenue guidance. Instead of offering a revenue range, Etsy offers a range for its take rate and then asks its investors to do some math to figure out revenue projections.

Etsy aims to have a 21%-21.5% take rate. Assuming GMS drops by 3% year-over-year from Q1-2023 levels, we end up with a consolidated GMS of $3.0 billion. This consolidated GMS implies $637.5 million in revenue. This would be a year-over-year decrease compared to the $640.9 million reported in Q1 2023.

Perhaps Etsy wanted people to calculate its revenue with a projected take rate rather than offering actual guidance because revenue may decrease year-over-year. The company suggested that Q1 2024 will be the worst of it before revenue and GMS slowly recover. I find it hard to believe things will get better from a company that latches onto 2020 results when describing growth rates.

Etsy also sees its revenue growth outpacing GMS growth, which is concerning for the long-term narrative.

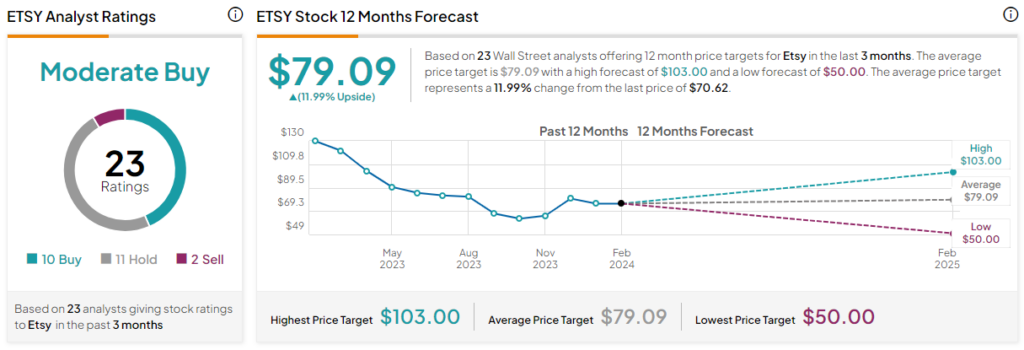

Is ETSY Stock a Buy, According to Analysts?

Etsy is currently rated as a Moderate Buy, with 10 of 23 analysts giving it a Buy rating. The stock has two Sell ratings, with the lowest price target set at $50. I believe Etsy is likely to head in that direction. Nonetheless, the average ETSY stock price target of $79.09 implies 12% upside potential.

The Bottom Line on ETSY Stock

Etsy overheated during the pandemic and still hasn’t found ways to generate more revenue growth ever since. Consolidated GMS has been declining, and revenue isn’t that far behind. The growth story is dead for this stock, and its valuation needs to change accordingly. A 28 P/E ratio is excessive, especially for a company that continues to report year-over-year net income declines.

Etsy had its run, but it’s not a buying opportunity just because it’s in the e-commerce industry and well off its all-time highs. I believe that investors should steer clear of this stock after a bad earnings report that indicated more pain is on the way.