EQT has inked a deal to sell Apleona Group, previously part of industrial services conglomerate Bilfinger, to private equity company PAI Partners SAS for about EUR 1.6 billion ($1.94 billion).

EQT bought Apleona in 2016 through a carve-out from Bilfinger SE (GB:0NRG). Under the terms of the agreement, certain shares in the proceeds will be shared with Bilfinger, resulting in expected proceeds of about EUR 450 million-470 million to Bilfinger’s preferred participation note. The transaction is expected to close in the second quarter of 2021, pending customary conditions and approvals. Deutsche Bank acted as a financial advisor to EQT.

Based in Germany, Apleona provides technical facility management services, complemented by infrastructural and commercial facility management as part of an integrated offering. Today, Apleona has more than 20,000 employees, managing tens of thousands of buildings and offices in over 30 countries across Europe.

“Today, Apleona is the market leader in the technical and integrated facilities management space,” commented Andreas Aschenbrenner, Partner at EQT Partners. “It has a strong platform to continue to drive market consolidation and further key account wins as the partner of choice for its blue-chip clients.”

EQT is a global buyout fund group with more than EUR 75 billion in raised capital and more than EUR 46 billion in assets under management across 16 active funds. Bilfinger is primarily active in engineering, maintenance, and technologies services in Europe, North America and the Middle East. The conglomerate has 34,000 employees and generated revenues of €4.327 billion in financial year 2019.

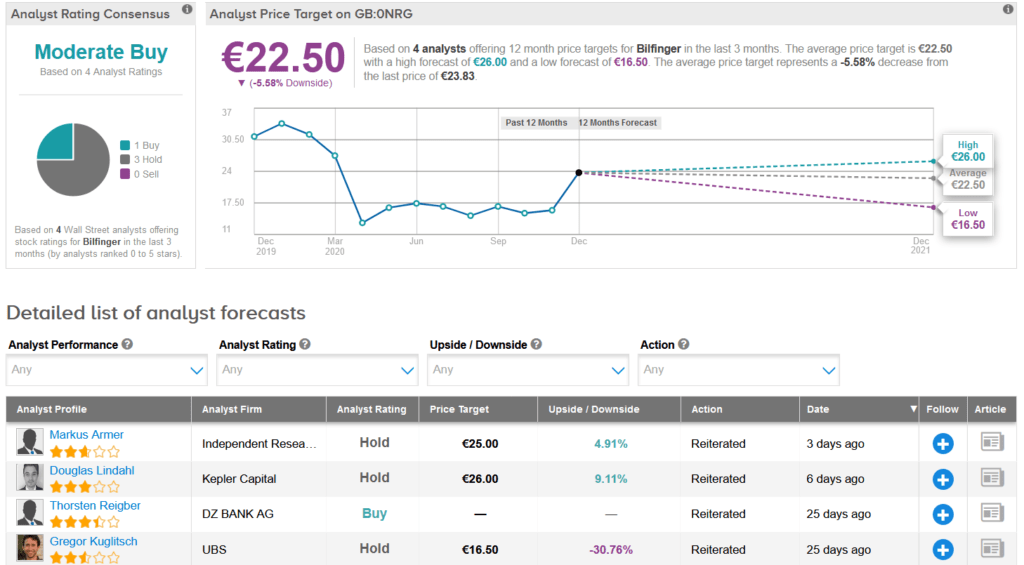

Bilfinger shares are down 31% so far this year and the stock scores a Moderate Buy analyst consensus. That’s based on 1 Buy rating versus 3 Hold ratings. (See Bilfinger stock analysis on TipRanks)

Looking ahead, the average price target stands at EUR 22.50, and implies 5.6% downside potential lies ahead over the coming year.

Related News:

Ollie’s Bargain Sinks 10% As 4Q Sales Trends Slow; Goldman Cuts To Hold

Five Below’s Profits Double in 3Q; Berenberg Sticks to Hold

Costco’s November Sales Lag Expectations; Oppenheimer Stays Bullish