Shares of Ollie’s Bargain plunged 9.8% on Dec. 4 as the discount retailer indicated a slowdown in fourth quarter sales trends. For the third quarter of fiscal 2020 (ended Oct. 31), the company exceeded analysts’ expectations.

Third-quarter sales grew 26.7% year-over-year to $414.4 million, surpassing analysts’ estimate of $406 million. Ollie’s (OLLI) top line was driven by comparable store sales growth of 15.3% and the strong performance of new stores. The company attributed the sales of its value merchandise offerings to a shift in spending from categories impacted by the pandemic, like travel, dining and experiences, to retail as well as the favorable impact of government stimulus in the early part of the quarter.

Meanwhile, 3Q adjusted EPS rose 58.5% year-over-year to $0.65 as operating margins expanded driven by improved merchandise margin and tight expense controls. Analysts were expecting an adjusted EPS of $0.58.

For 4Q, the company stated that its comparable store sales growth is tracking in the low single-digits quarter-to-date, indicating moderation from the double-digit growth in 3Q. (See OLLI stock analysis on TipRanks)

Ollie’s CEO John Swygert stated “That said, this holiday season is subject to many uncertainties regarding the impact of the pandemic and there are a lot of large volume days still ahead of us. What we do know is that value will always be a priority for the consumer and we have a proven ability to navigate uncertain times. As always, we will tightly manage what is in our control and we feel very good about our ability to provide exciting holiday deals to our customers.”

The slowdown in 4Q sales trends prompted Goldman Sachs analyst Chandni Luthra to downgrade the stock’s rating to Hold from Buy and lower the price target to $95 from $122. Luthra noted that the company “revealed a sharp slowdown in 4th quarter-to-date trends and alluded to uncertainty around the timing of mega deals (bigger closeout deals) in 2021.”

“We continue to view OLLI as a strong operator and a unit growth story offering extreme value to customers in a unique treasure hunt format, but we expect valuation to be range-bound in the near-term, especially with tougher compares looming in 2021,” added Luthra.

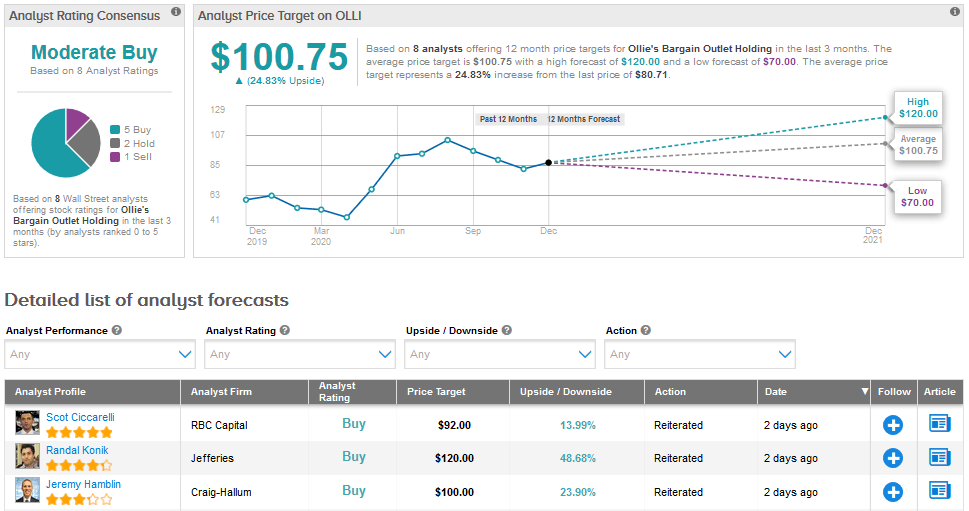

The rest of the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 5 Buys, 2 Holds and 1 Sell. The average price target of $100.75 indicates upside potential of 24.8% in the months ahead.

Related News:

Kroger Drops 4% As 3Q Sales Lag Estimates, Oppenheimer Remains Sidelined

Mondelez Approves $4B Share Buyback Plan; Street Is Bullish

Five Below’s Profits Double in 3Q; Berenberg Sticks to Hold