Shares of eBay spiked 10% in Thursday’s pre-market session as the e-commerce platform’s quarterly results outperformed forecasts, fueled by online shopping demand during the holiday season.

In the fourth quarter ended Dec. 31, eBay (EBAY) sales jumped 28% to $2.87 billion year-on-year, exceeding analysts’ expectations of $2.70 billion, as refurbished gifts emerged as a top trend for its holiday shoppers. The auction platform earned an adjusted $0.86 per share in 4Q, beating the Street consensus of $0.83 cents per share.

The number of annual active buyers grew by 7%, to a total of 185 million global active buyers. Additionally, total advertising revenue passed the $1 billion mark in 2020, the company said.

“I am proud eBay was able to be there for our buyers, sellers and community, especially in the face of a global pandemic,” said eBay CEO Jamie Iannone. “We finished the year with strong financial results…we’ve been able to extend to small businesses – providing them with tools, resources and access to millions of buyers globally. We will continue to invest in product and technology in order to deliver the best marketplace in the world for our customers.”

On the back of the better-than-expected earnings results, eBay’s board of directors approved an increase of its quarterly dividend by 13% to $0.18 per share and announced the expansion of its share repurchase program by an additional $4 billion. The dividend is payable on March 19 to stockholders of record as of March 1.

Looking ahead to the current quarter, eBay expects to generate first-quarter sales of between $2.94 billion to $2.99 billion, which is higher than the $2.53 billion estimated by analysts.

Ebay shares have been on a phenomenal run, rallying 56% over the past year as more people ordered online while pandemic-led stay-at-home orders were in place and businesses were shifting to e-commerce. (See eBay stock analysis on TipRanks)

The quarterly results prompted Stifel Nicolaus analyst Scott Devitt to lift his price target to $80 from $70 and maintain a Buy rating on the stock.

“In our view, improvements in the core marketplace business, focused on enhancements to the buyer/seller experience and development of new verticals are underappreciated by the market, as investors remain cautious approaching difficult comps beginning in 2Q,” Devitt wrote in a note to investors. “Though deceleration is expected, shares aftermarket trade at just 8.2x 2022E EV/EBITDA (adjusted for warrant and Classifieds sale) and 13.0x 2022E Non-GAAP EPS, below marketplaces and traditional omni-channel retail. Additionally, eBay has a history of shareholder-friendly capital allocation.”

“Increased monetization through promoted listings is significant for eBay and will become more meaningful in 2021,” the analyst added.

The rest of the Street has a cautiously optimistic outlook on the stock. The Moderate Buy consensus rating shows 2 Buys versus 4 Holds. The average analyst price target of $63.20 now implies 9% upside potential over the next 12 months.

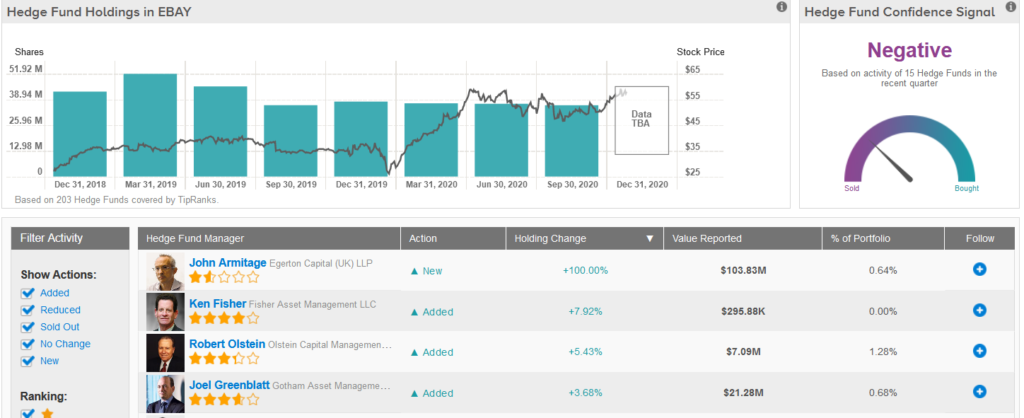

Meanwhile, TipRanks’ Hedge Fund Trading Activity barometer shows that confidence in EBAY is currently negative as 15 hedge funds trimmed their cumulative holdings in the stock by 740.4K shares in the last quarter.

Related News:

PayPal Jumps 5.5% As 4Q Sales Outperform; Street Sticks To Buy

MetLife’s 4Q Profit Beats Estimates; Shares Gain

Costco’s January Sales Surge 18% As E-Commerce Booms; Street Is Bullish