The Dow Jones (DJIA) is trading in negative territory on Thursday as the government shutdown extends to its ninth day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Once again, funding bills from both Democrats and Republicans failed to pass in the Senate as the two sides remain entrenched in disagreements with healthcare subsidy extensions at center stage. The failed passage comes amid another Democratic funding cut threat from President Trump.

“We’ll be making cuts that will be permanent, and we’re only going to cut Democrat programs,” Trump said. “I hate to tell you, I guess that makes sense, but we’re only cutting Democrat programs.”

The shutdown has put data from federal agencies on pause, placing greater importance on data from the private sector. According to OpenBrand, the prices of consumer durables and personal goods increased for a tenth consecutive month in September, rising by 0.58%. The end of the “de minimis” exemption in August, which allowed duty-free imports of goods worth less than $800, likely contributed to rising prices in personal care and communication goods, which both experienced a 0.76% increase. On the other hand, the prices of appliances and home improvement goods decelerated, “a possible sign that the impacts of tariffs on these product groups may be starting to wane,” said OpenBrand.

Meanwhile, the IRS announced tax changes for the 2026 tax year, potentially benefiting millions of Americans in the process. The standard deduction received a boost, rising to $16,100 from $15,750 for single filers and $32,200 from $31,500 for married couples filing jointly. The IRS also raised marginal tax brackets for both single filers and married couples filing jointly, with the maximum tax rate remaining at 37%.

The Dow Jones is down by 0.57% at the time of writing.

Which Stocks are Moving the Dow Jones?

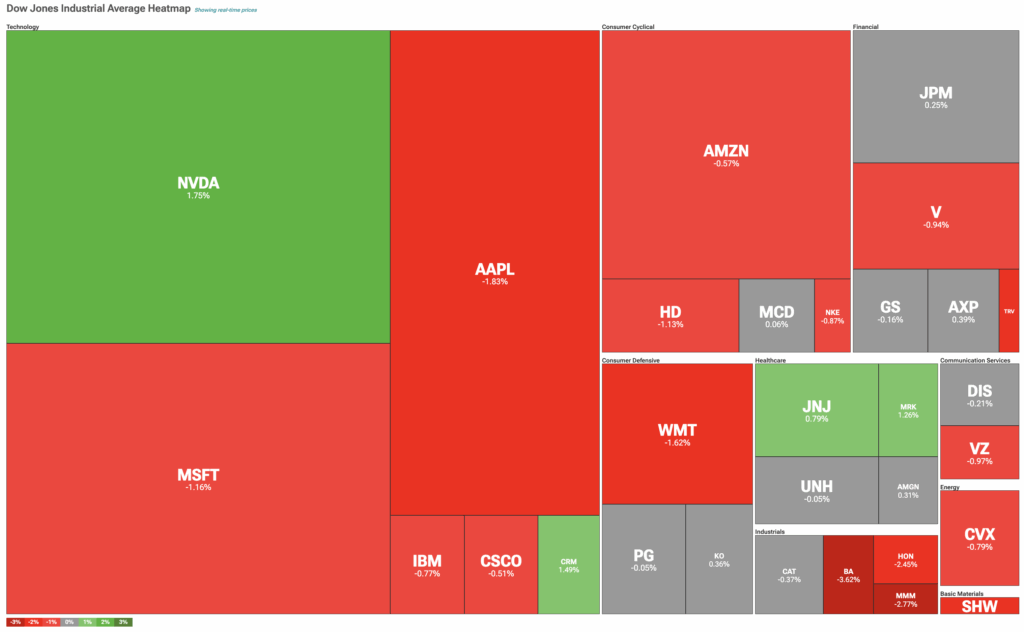

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Most technology stocks are trading lower on Thursday, although Nvidia (NVDA) managed to secure yet another record high of $195.30. Other Magnificent 7 members, like Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN), are in the red.

Meanwhile, Boeing (BA) is dragging industrial stocks lower after Turkish Airlines Chair Ahmet Bolat said that the airline may switch its Boeing 737 MAX order to competitor Airbus (EADSY) if its talks with engine supplier CFM fall short.

Elsewhere, Chevron (CVX) is taking a hit from falling oil futures, while Johnson & Johnson (JNJ) is shaking off news that it will have to pay $966 million to settle allegations of its talc baby powder causing cancer. The healthcare company plans to appeal the verdict.

DIA Stock Moves Lower with the Dow Jones

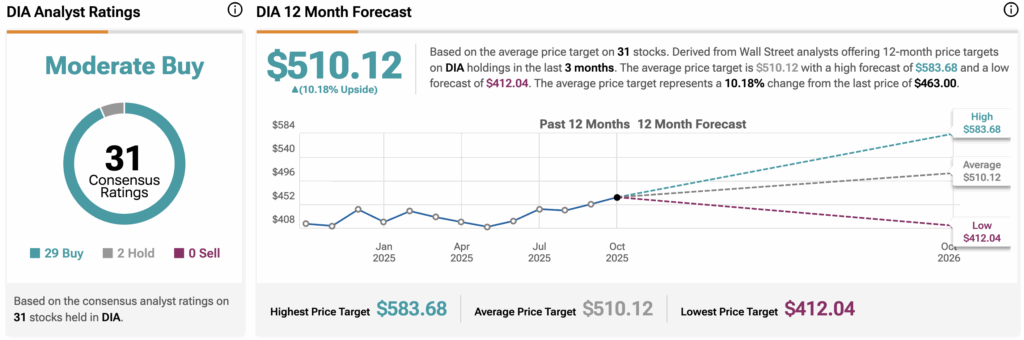

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is falling alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $510.12, implying upside of 10.16% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.