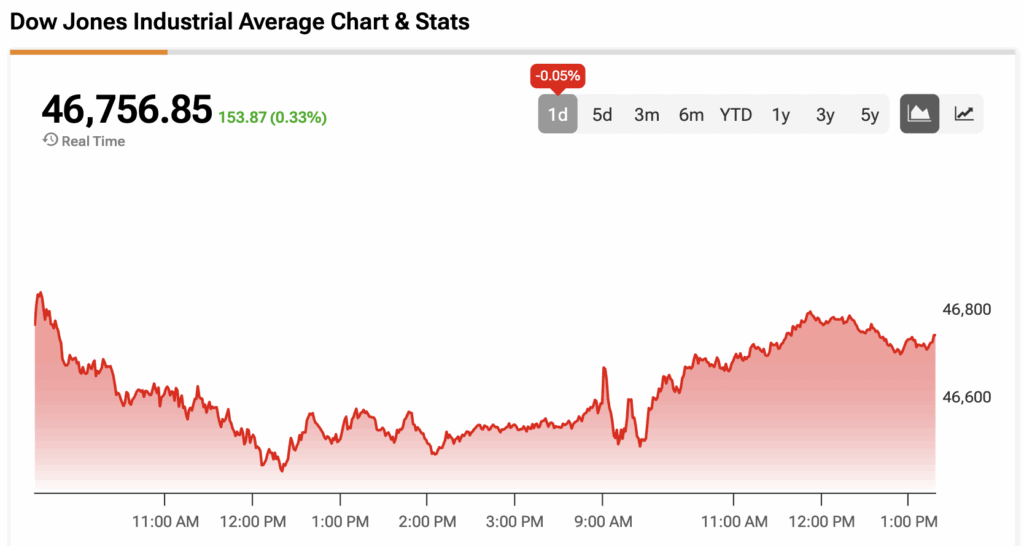

The Dow Jones (DJIA) is trading higher today and is less than 1% away from surpassing its all-time high of 47,049.64.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The government shutdown has stretched to its eighth day, and the prospects of a reopening remain bleak. On Wednesday, the Senate failed to pass both Democrat- and Republican-backed funding bills as the two parties continue to disagree on extending Affordable Care Act (ACA) subsidies and play the blame game.

“The first responsibility of the government is to protect the people,” said House Speaker Mike Johnson. “And the people who are supposed to be protected are being completely cheated by Democrats in the Senate because they want to play politics.”

President Trump’s approval rating has matched a term-low of 40% amid the shutdown, according to a poll conducted by Reuters and Ipsos. Respondents were also concerned with his use of the National Guard in Democratic-led cities, with 58% saying that armed troops should only be used to counter external threats.

The shutdown hasn’t dampened the stock market, and higher growth could be on the way, according to Wells Fargo. The bank raised its real 2025 gross domestic product (GDP) growth estimate to 2.0% and its 2026 estimate to 2.3% on the heels of resilient consumer spending. In September, the Commerce Department revised second quarter consumer spending growth to 2.5% from 1.6%.

Furthermore, Wells Fargo expects two rate cuts before year-end and two more during the first half of 2026. That would bring the federal funds rate to between 3.00% and 3.25%. Each rate cut is equal to 25 basis points.

The Dow Jones is up by 0.33% at the time of writing.

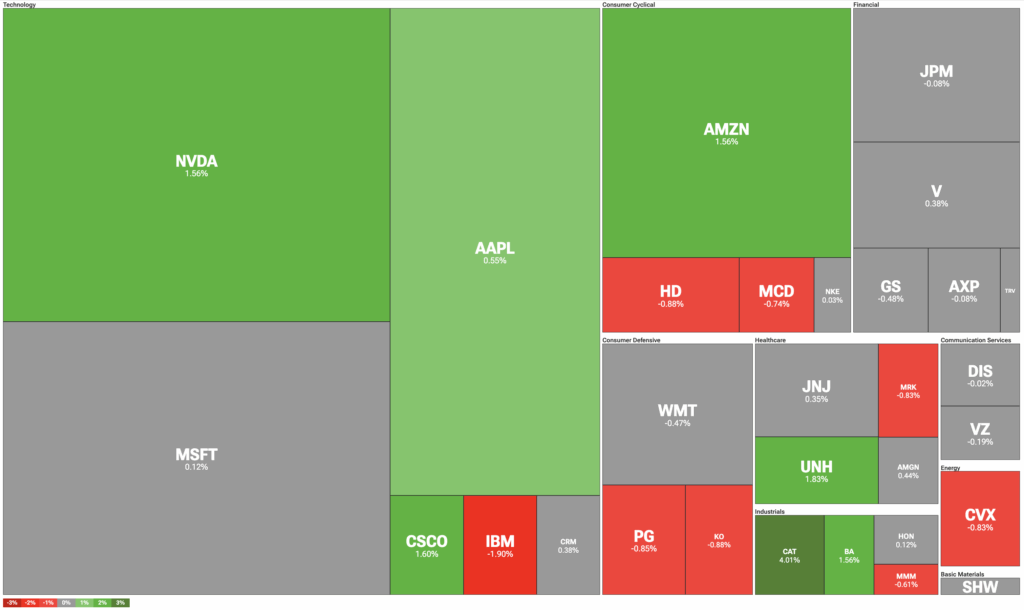

Which Stocks are Moving the Dow Jones?

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Caterpillar (CAT) is the top performer within the index and is up by about 20% during the past month. Earlier this week, the industrial equipment company announced that it would maintain its dividend of $1.51, payable on November 20.

Meanwhile, Nvidia (NVDA) is flirting with its all-time high after CEO Jensen Huang told CNBC that computing demand has “gone up substantially” and that demand for the company’s Blackwell GPU is “really, really high.”

Elsewhere, all five financial stocks are muted on the day, while UnitedHealth Group (UNH) is continuing its winning streak, rising by 15% during the past month.

DIA Stock Moves Higher with the Dow Jones

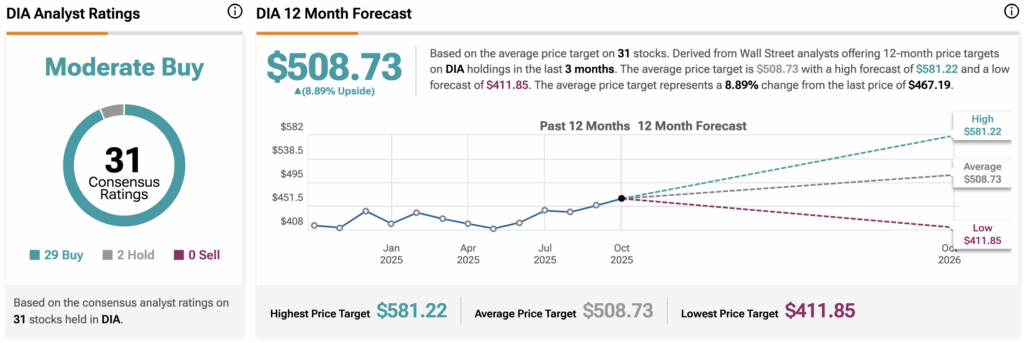

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to rise. During the past three months, analysts have issued an average DIA price target of $508.73, implying upside of 8.89% from current prices. The 31 holdings in DIA carry 29 buy ratings, two hold ratings, and zero sell ratings.

Stay ahead of macro events with our up-to-the-minute Economic Calendar — filter by impact, country, and more.