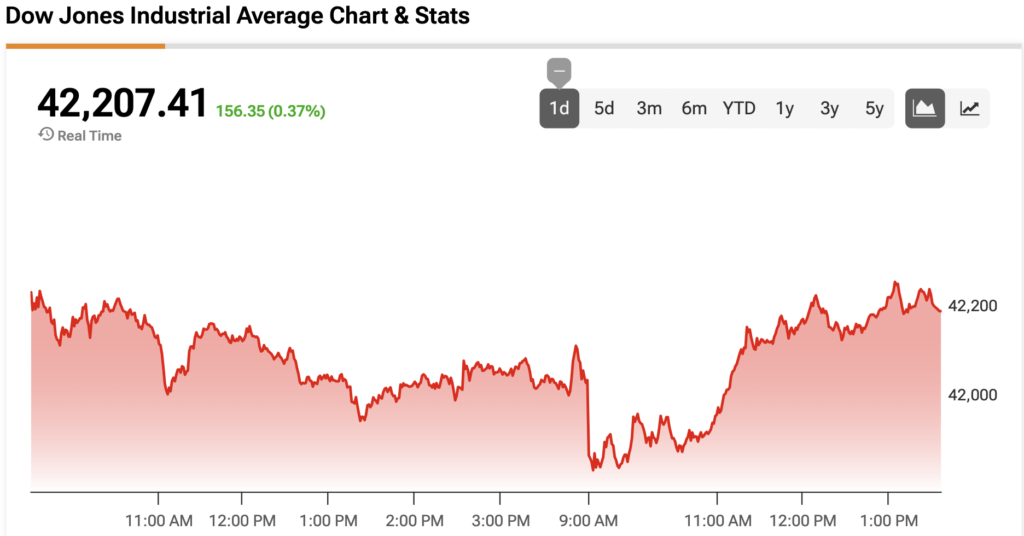

The Dow Jones Industrial Average (DJIA) has reversed its morning losses amid a significant drawdown in UnitedHealth (UNH) stock.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Yesterday, the Wall Street Journal reported that the Department of Justice is investigating UnitedHealth for fraud in relation to its Medicare Advantage health plans. Earlier this week, the healthcare company suspended its 2025 guidance and disclosed that its CEO would step down in a surprising move. UnitedHealth responded to the allegations by saying that it hasn’t been notified by the DOJ of any investigation, calling the WSJ report “deeply irresponsible.”

UNH stock carries a 4.49% weight in the Dow Jones and is the seventh largest component within the index. Shares of UnitedHealth are down by about 13%, bringing its one-month loss to 54%.

Meanwhile, WMT stock is down by less than half a percent after the world’s largest retailer reported its first quarter earnings. It was down by nearly 5% this morning before recovering higher. While Walmart beat on both revenue and EPS, the company warned that it would likely raise prices as a result of the tariffs. WMT carries a 1.41% weight in the Dow Jones.

The Dow Jones is up by 0.37% at the time of writing.

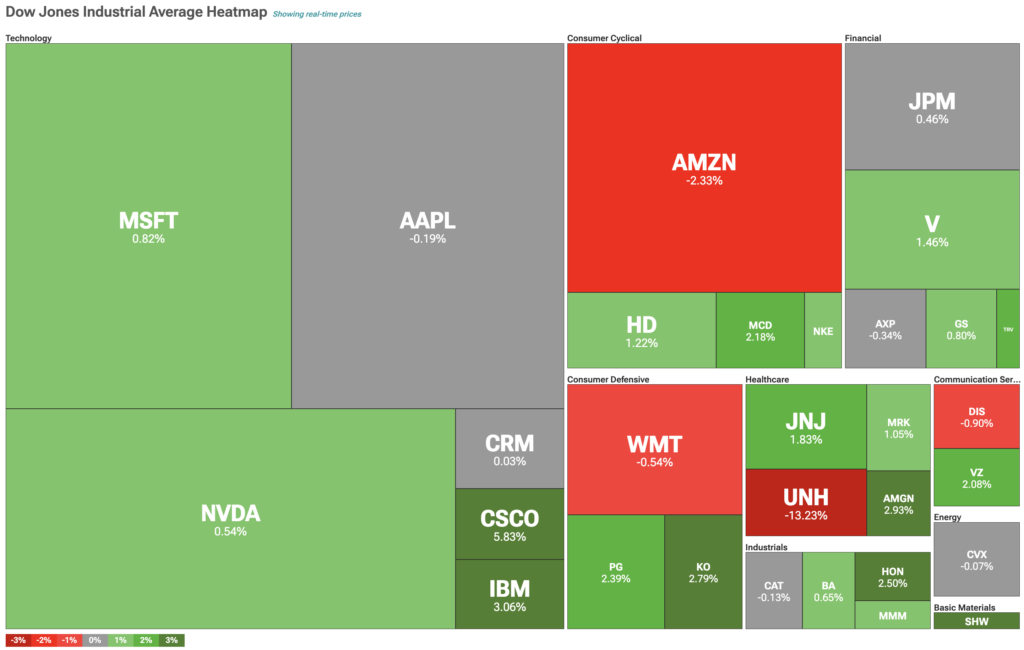

Which Stocks are Moving the Dow Jones?

Let’s take a look at TipRank’s Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

UNH is noticeably red while Walmart’s price hike warning is sending Amazon (AMZN) lower. Excluding UNH, the three other healthcare stocks in the Dow Jones are mounting a recovery following President Trump’s executive order on drug prices. Meanwhile, Cisco (CSCO) is up by 5.83% after a solid earnings report.

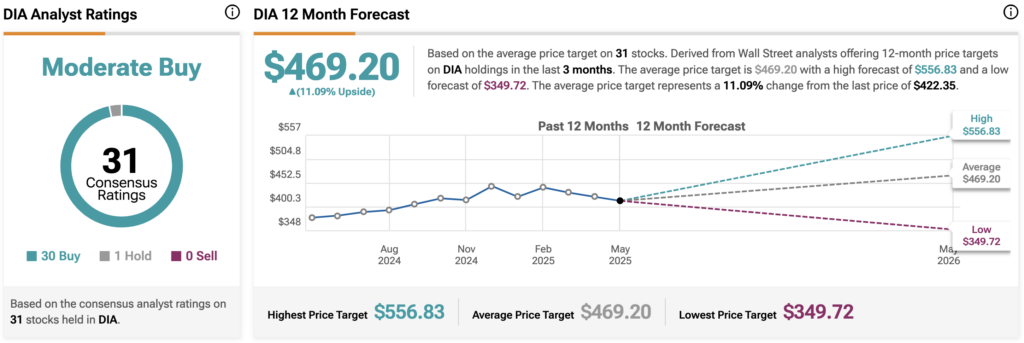

DIA Stock Moves Lower with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the price movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock carries further upside. During the past three months, analysts have issued an average DIA price target of $469.20 for the stocks within the index, implying upside of 11.09% from current prices. The 31 stocks in the DIA carry 30 buy ratings, 1 hold rating, and zero sell ratings.