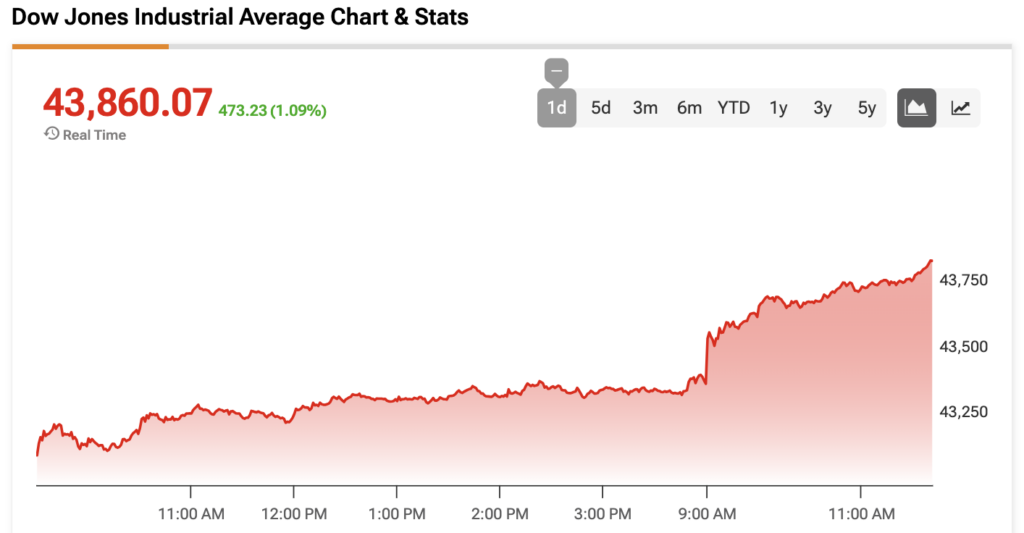

While the S&P 500 (SPX) and Nasdaq 100 (NDX) have secured new all-time highs on Friday, the Dow Jones (DJIA) has yet to check off this achievement. However, the index is nearly there and will be able to join the club with a 3% rise.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This morning, the core personal consumption expenditures (PCE) index, which is the Fed’s preferred gauge of inflation, came in above expectations. Core PCE for May rose by 0.2% month-over-month and 2.7% year-over-year, both of which were above their respective estimates for 0.1% and 2.6%. The core PCE index excludes volatile food and energy prices from the PCE index. May’s PCE index increased by 0.1% MoM and 2.3% YoY, which were in line with the estimates. Both of these indexes measure the prices that consumers pay for goods and services.

Offsetting the disappointing core PCE was a better-than-expected Index of Consumer Sentiment. The index increased by 16% from May, reaching 60.7, which was better than the expectation for 60.5. May’s reading also marked the first increase in six months. In addition, expectations for inflation fell, with the year-ahead forecast now at 5.0% from 6.6% and the long-run forecast at 4.0% from 4.2%.

“Despite June’s gains, however, sentiment remains about 18% below December 2024, right after the election; consumer views are still broadly consistent with an economic slowdown and an increase in inflation to come,” said Survey of Consumers Director Joanne Hsu.

The Dow Jones is up by 1.09% at the time of writing.

Which Stocks are Moving the Dow Jones?

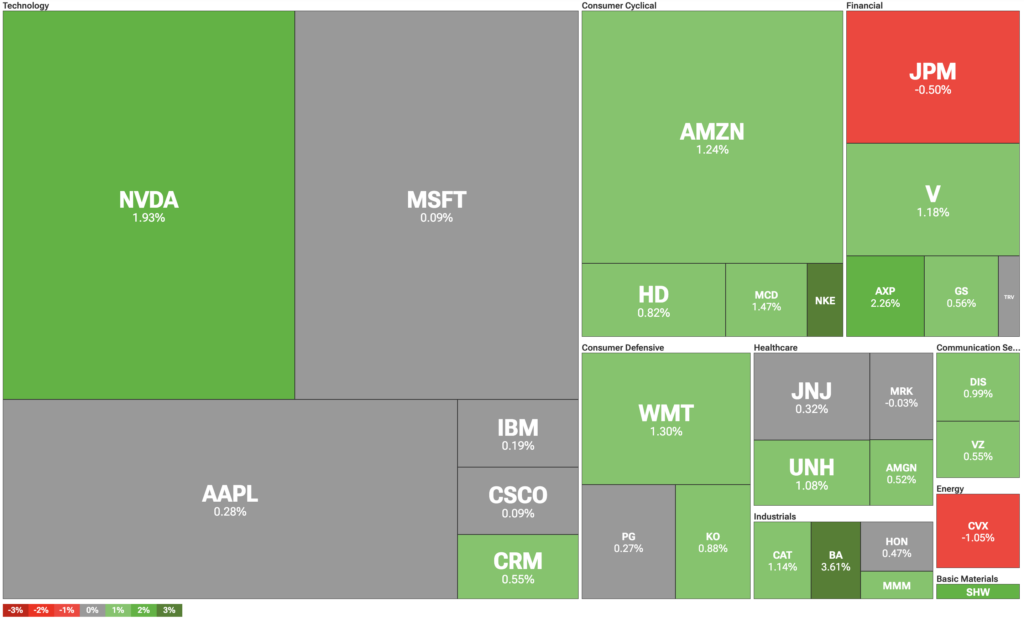

Let’s pivot to TipRanks’ Dow Jones Heatmap, which illustrates the stocks that have contributed to the index’s price action.

Nvidia (NVDA) is leading all Dow Jones tech components on Friday and is continuing its remarkable streak. On top of that, President Trump is planning a series of executive orders to bolster AI development, according to Reuters.

Boeing (BA) commands the largest gain among all of the companies in the index as it looks to recover from losses stemming from the Air India crash. This morning, Rothschild & Co Redburn analyst Olivier Brochet raised his BA stock price target to $275 from $180.

On the other hand is Chevron (CVX), which has fallen during the past week as oil loses its premium from the Israel-Iran war amid a ceasefire.

DIA Stock Moves Higher with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to track the movement of the Dow Jones. As a result, DIA is rising alongside the Dow Jones today.

Wall Street believes that DIA stock has room to run. During the past three months, analysts have issued an average DIA price target of $462.12 for the stocks within the index, implying upside of 5.58% from current prices. The 31 stocks in DIA carry 30 buy ratings, 1 hold rating, and zero sell ratings.