Red is the color of the day as the Dow Jones Industrial Jones (DJIA) has plunged more than 700 points on Wednesday.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Fears of rising debt from Trump’s bill and a weak 20-year Treasury bond auction have contributed to the downside. According to the Congressional Budget Office, the bill could add $3.8 trillion to the nation’s debt balance over the next ten years. That’s on top of the current $36.2 trillion debt pile.

Meanwhile, Wednesday afternoon’s 20-year bond auction ended in disappointment with weak demand. The high yield was 5.047% compared to the previous yield of 4.810%, sending the 10, 20, and 30-year Treasury yields soaring higher and stocks lower.

On a brighter note, Amazon’s CEO stated that customer demand and average prices on its website have not been affected by the tariffs. “We’ve not seen any attenuation of demand at this point,” said Jassy at Amazon’s annual shareholder meeting, adding that Amazon hasn’t experienced “any meaningful average selling price increases.” Amazon is the 18th largest constituent in the index with a 2.94% weight.

The Dow Jones is down by 1.81% at the time of writing.

Which Stocks are Moving the Dow Jones?

So, which stocks are responsible for the downside today? We can turn to TipRank’s Dow Jones Heatmap to find out.

UnitedHealth Group (UNH) is facing the most significant fall and is down by 5.77%. This morning, The Guardian accused the healthcare giant of sending hidden payments to nursing homes in order to reduce hospital transfers, which UnitedHealth later denied in a response.

In addition, every single financial stock within the index is falling today as economic uncertainty and tariff impacts continues to weigh on them. Technology stocks are also facing the heat with Apple (AAPL) facing the most severe loss.

DIA Stock Drops with the Dow Jones

The SPDR Dow Jones Industrial Average ETF (DIA) is an exchange-traded fund designed to emulate the performance of the Dow Jones.

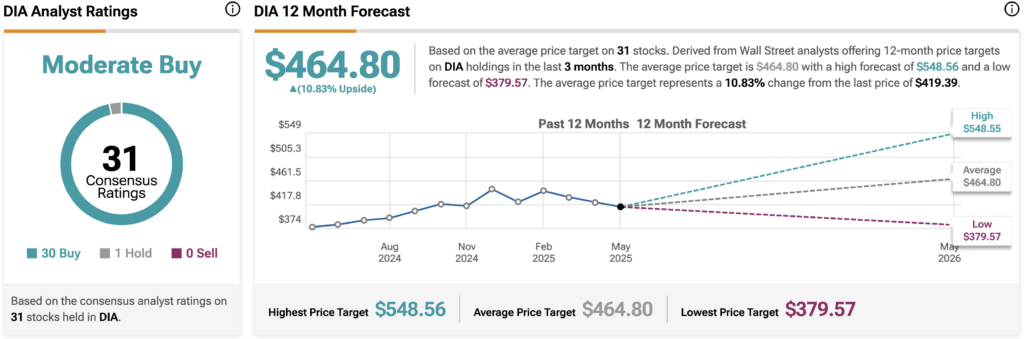

Wall Street carries a bullish stance on DIA stock. During the past three months, analysts have issued an average DIA price target of $464.80 for the stocks within the index, implying upside of 10.83% from current prices. The 31 stocks in the DIA carry 30 buy ratings, 1 hold rating, and zero sell ratings.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue