Power and energy company Dominion Energy, Inc. (NYSE:D) recently announced the conclusion of the sale of Questar Pipelines to Southwest Gas Holdings, Inc. (NYSE:SWX) for about $2 billion, including $430 million of existing debt. The deal was previously announced on October 5, 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Following the news, shares of the company rose marginally to close at $78.56 on Friday.

Strategic Impact

With the proceeds from the concluded sale, Dominion Energy will be looking to decrease its parent-level debt, including retiring the 364-day term loan that was taken in July, which Dominion Energy previously used to repay an approximately $1.3 billion transaction deposit made by Berkshire Hathaway Energy.

Further, the proceeds will be utilized to lend strength to Dominion’s capital plan.

See Top Smart Score Stocks on TipRanks >>

Analyst Ratings

Recently, Morgan Stanley analyst Stephen Byrd reiterated a Hold rating on the stock. The analyst, however, raised the price target from $78 to $83, which implies upside potential of 5.7% from current levels.

The Wall Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 4 Buys and 3 Holds. The average Dominion Energy price target of $82.43 implies that the stock has upside potential of 4.9% from current levels. Shares have gained about 6.3% over the past year.

Positive Sentiment

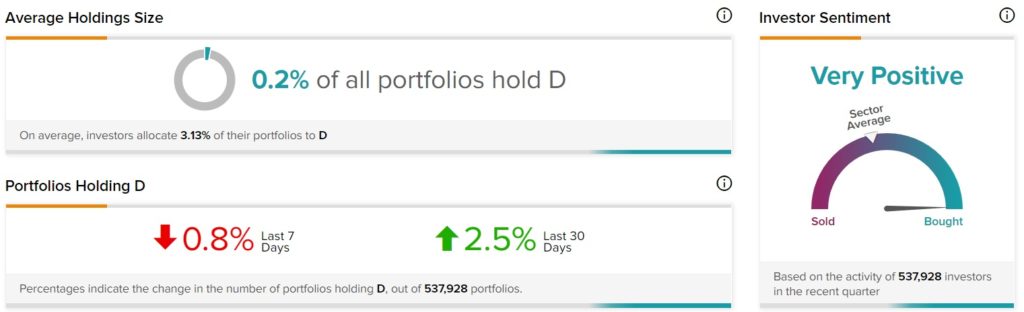

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on D. Further, 2.5% of portfolios tracked by TipRanks increased their exposure to D stock over the past 30 days.

Download the mobile app now, available on iOS and Android.

Related News:

Teva Found Guilty of Fueling New York Opioid Crisis

AMD Plans to Close Xilinx’s Acquisition in Q1 2022 – Report

American Electric Closes Sale of Racine Hydro Plant; Street Says Buy