When we look at the valuation metrics of U.S. banks JPMorgan (NYSE:JPM) and Bank of America (NYSE:BAC) and compare them with peers in the UK, it may be unclear as to why the U.S. bank stocks trade at such a premium to their British peers, Lloyds Bank (LSE:LLOY) (NYSE:LYG) and Barclays (LSE:BARC) (NYSE:BCS). However, the consensus among many observers of bank stocks, is that investors are still dominated by the bad memories of the Great Financial Crisis of 2007-09.

As such, investors could be looking at a traditional, long-term, Warren Buffett-esque value play when it comes to British bank stocks, as the valuation premiums U.S. banks carry make them weaker investments. I’m bullish on Lloyds and Barclays stocks, but neutral on JPMorgan and Bank of America stocks.

Caution Reigns

Investor sentiment in the UK has been pretty poor for some time. The Brexit vote and the resulting uncertainty played a part in this. However, British bank stocks appear to be even less popular than the rest of the index, with investors honing in on any sign of bad news in recent years. As noted before, there’s certainly an element of caution that relates to the challenging circumstances that arose during the Great Financial Crisis of 2007-09. “In sum, the bad memories of the Great Financial Crisis of 2007-09 continue to dominate investors’ perception of the stocks,” said Russ Mould, investment director at AJ Bell.

While both U.S. and UK banks were heavily affected by the financial crisis, it’s arguable that the type of government intervention resulted in differing outcomes for shareholders. The UK government was more direct in its approach to the crisis, nationalizing some banks, including Northern Rock and Bradford & Bingley.

It also took majority ownership in others including Royal Bank of Scotland. American bailouts were generally structured as loans or investments. Whether this is a factor or not, it’s true that sentiment has recovered much more strongly in the U.S. than in the UK.

Banks are, of course, cyclical stocks. When the economy is strong, banks tend to do fairly well. When the economy is weak, they often struggle. Thus, part of the premium attached to U.S. bank stocks can be attributed to the strength of the economy relative to the current stagnation in the UK. However, investors must look forward, and its worthwhile recognizing that the UK is expected to be Europe’s best-performing major economy in the next 15 years.

The Centre for Economics and Business Research (CEBR) says that UK GDP growth will settle between 1.6% and 1.8% per year until 2038. That makes it faster than all other major European economies but slightly slower than the United States. In turn, this raises the question of whether U.S. banks really deserve to be trading at higher valuations versus their British peers.

The Valuation Premiums on Bank Stocks

So, how big are the premiums we’re looking at?

- JPMorgan trades at 12.2x forward earnings. This falls to 12.1x and 11.1x in forward years two and three.

- Bank of America trades at 11.7x forward earnings. This falls to 10.85x and 9.5x in forward years two and three.

- Lloyds Bank trades at 8.1x forward earnings. This falls to 7x and 6.55x in forward years two and three.

- Barclays Bank trades at 6.3x forward earnings. This falls to 5x and 4.75x in forward years two and three.

Of course, it’s challenging to make direct comparisons between two banks, let alone four. However, it’s worth noting that Lloyds doesn’t have an investment bank, and therefore, investors may be wary about investing in a bank that is very focused on the UK mortgage market.

Meanwhile, although Barclays appears to be turning a corner, it’s had a traditionally rocky relationship with regulators and has incurred some sizeable fines in recent years. By comparison, JPMorgan and Bank of America are true giants of the banking world — in a way reminiscent of several British banks prior to the financial crisis. These are institutions with unparalleled access to the fast-growing US market and have global reach.

Are JPM and BAC Stocks Buys, According to Analysts?

JPMorgan is rated a Moderate Buy by analysts covering the stock in the past three months. The bank has 17 Buys and six Hold ratings. The average JPMorgan stock price target is $196.84, indicating 1.35% downside potential.

Bank of America is also rated a Moderate Buy by analysts covering the stock in the past three months. The bank has 10 Buy ratings, eight Hold ratings, and one Sell ratings. The average Bank of America stock price target is $38.15, inferring 0.9% upside potential.

See how the two stocks compare below.

Are LYG and BCS Stocks Buys, According to Analysts?

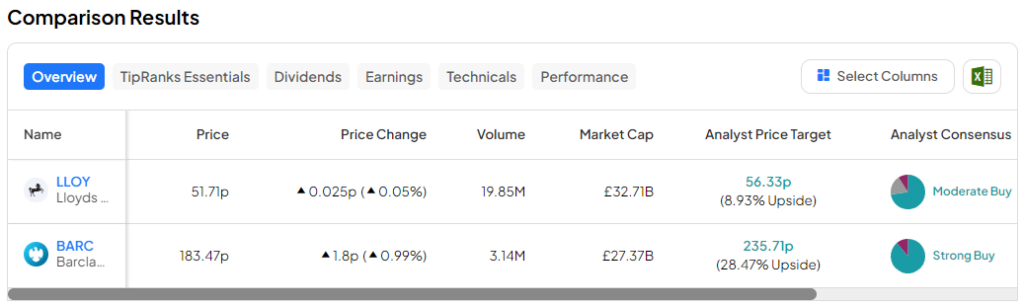

Lloyds stock comes in as a Moderate Buy. The bank has been assigned eight Buys, two Holds, and one Sell rating. The average Lloyds Bank stock price target is 56.33p, indicating 8.9% upside potential.

Meanwhile, Barclays has a Strong Buy rating. The bank has eight Buys and one Sell rating. The average Barclays Bank stock price target is 235.71p, implying 28.5% upside potential.

The Bottom Line

American banks JPMorgan and Bank of America are representative of the premium valuations afforded to U.S. stocks versus overseas peers, notably those in the UK. Given the economic forecast and relative valuations, Barclays Bank and Lloyds Bank look like stronger bank stock investment opportunities than those in the U.S.