Within a week of taking over as CEO of Walt Disney (NYSE:DIS), Robert A. Iger is required to take action to rescue the company’s ailing animation division. The latest release, “Strange World,” is Disney’s second straight flopped animation movie this year, having collected merely $18.6 million in the five-day Thanksgiving period.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While resuming his new role in the office, Iger hinted at making changes to its animation division. He has tasked four of the top executives to make restructuring plans, asking them to “work together on the design of a new structure that puts more decision-making back in the hands of our creative teams and rationalizes costs.”

Interestingly, only one of the animated movies Disney released since 2020 has performed well. The failure of this division could be attributed to the decisions made by ex-CEO Bob Chapek, to some extent.

Early in 2020, Chapek took hold of Disney when the theatres were shutting down due to COVID-19 restrictions. To increase subscribers, he decided to release movies on Disney’s streaming platform, Disney+. It is possible that this may have impacted theater ticket sales, because people may have preferred to wait for the film to be released on OTT (Over-the-Top) and watch it at home rather than going to the theaters.

Further, confusion among viewers about which movie will be a theatrical release and which one will come on Disney+ may have impacted attendance in theatres.

Additionally, another decision made by Chapek, which gave the power of making distribution route decisions to some executives, could have impacted the performance of the animation division.

Is DIS Stock a Buy or Sell?

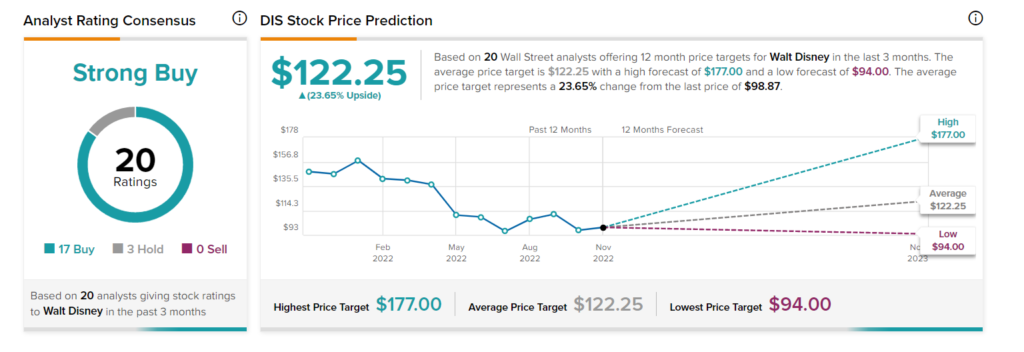

The Wall Street community is optimistic about DIS stock. Overall, the stock commands a Strong Buy consensus rating based on 17 Buys and three Holds. Disney’s average price target of $122.25 implies 23.65% upside potential from current levels.

The stock has a very positive signal from hedge funds as well. Our data shows that hedge funds bought 2.9M shares of DIS last quarter.