On his first day back as CEO at Walt Disney (NYSE:DIS), Robert A. Iger disclosed plans to shake up the Media and Entertainment Distribution unit to make it more efficient and improve the cost structure.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, Iger’s restructuring plans involved the departure of the company’s head of media and entertainment, Kareem Daniel. Further, the company may have some layoffs in the pipeline as Iger plans to rationalize costs for Disney’s loss-making unit.

The newly appointed CEO has assigned some of the top executives, including Dana Walden, chairman of Disney General Entertainment Content, and CFO Christine McCarthy, the task of making restructuring plans.

Is Disney Stock a Good Buy?

DIS stock is down about 38% year-to-date. However, the stock gained more than 6% on Iger’s comeback yesterday.

Also, several analysts maintained a bullish stance on Disney. Wells Fargo analyst Steven Cahall said that the departure of CEO Bob Chapek was not as surprising as the return of Iger. He is of the opinion that Iger has the capability to make bold changes in the company and improve the content aspects of Disney.

Jason Bazinet of Citigroup believes that Iger can help streamline the media unit and move it toward profitability.

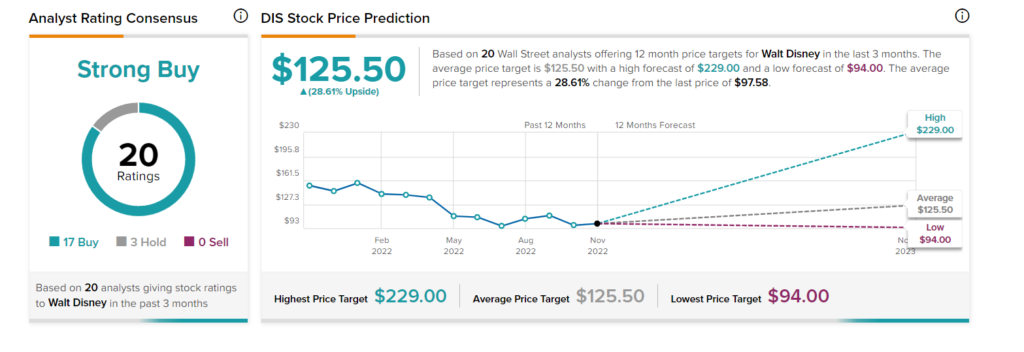

On TipRanks, Disney stock has a Strong Buy consensus rating based on 17 Buy and three Hold recommendations. The average DIS stock price target of $125.50 implies upside potential of 28.61%.