Walt Disney (NYSE:DIS) has gained an edge in the ongoing proxy battle against Nelson Peltz’s Trian Partners, the Wall Street Journal reported. Per the report, Disney has secured over half of all shares voted, bolstered by the support of its second-largest shareholder, BlackRock (NYSE:BLK), which holds around 4.2% of DIS shares.

BlackRock’s backing is crucial for Disney CEO Robert Iger to block Trian’s push for two seats on the board. Additionally, asset manager T. Rowe Price (NASDAQ:TROW), with a 0.5% stake in Disney, has also sided with the entertainment giant.

Despite Disney’s initial lead, the outcome of the contest remains uncertain. Investors are still casting votes, with the annual meeting scheduled for Wednesday, April 3.

The Core Issue

At the heart of the proxy battle are disagreements over Disney’s strategic direction and growth initiatives. Trian, led by Peltz, has contested Disney’s strategy, citing the underperformance of DIS stock compared to the broader market. Trian has also criticized Disney’s succession planning, debt levels, Direct-to-Consumer strategy, and executive compensation.

Earlier, the company’s founders’ heirs announced support for Iger. Moreover, Glass Lewis, a proxy voting and corporate governance advisory firm, suggested shareholders vote for Disney’s director nominees. However, Institutional Shareholder Services (ISS), a proxy advisory firm, sided with Nelson Peltz in the costliest shareholder contest ever.

Is Disney a Buy, Sell, or Hold Stock?

Disney stock is up about 35% year-to-date, outperforming the S&P 500’s (SPX) gain of about 10.16%. Moreover, Wall Street is bullish about its prospects as the company is taking initiatives to accelerate growth.

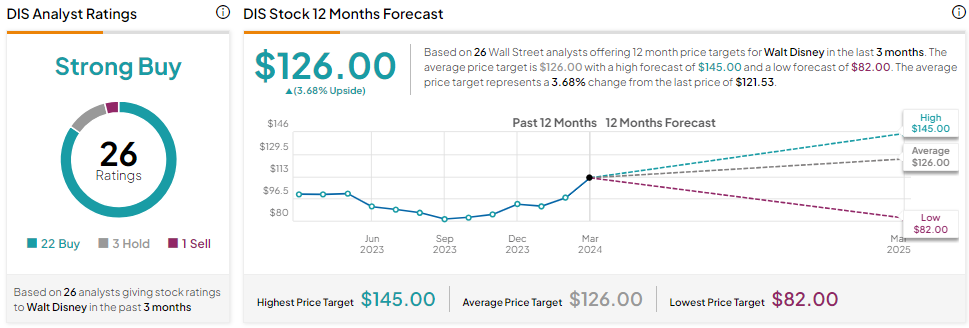

DIS stock has a Strong Buy consensus rating based on 22 Buys, three Holds, and one Sell. The analysts’ average price target on DIS stock of $126 implies a 3.68% upside potential.