The battle for a seat on entertainment giant Disney’s (NYSE:DIS) Board is expected to be the costliest shareholder contest ever, the Wall Street Journal reported. According to the report, Activist hedge funds, including Trian Fund Management led by Nelson Peltz and Blackwells Capital, alongside Disney itself, are projected to collectively spend over $70 million in preparation for the shareholder vote scheduled for April 3.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, the proxy fight primarily revolves around the disagreement over Disney’s strategy and efforts to bolster growth and its share price. In January 2023, Nelson Peltz initiated a proxy contest with Disney. Peltz’s Trian Fund Management challenged Disney’s strategy, citing the underperformance of DIS stock compared to the broader market. Trian criticized Disney for poor succession planning, a flawed Direct-to-Consumer strategy, excessive compensation, high leverage, and dividend elimination.

Meanwhile, Blackwells Capital, another DIS shareholder, submitted a proxy statement to the SEC, seeking three board seats. Blackwells emphasized that their nominees would enhance the board’s effectiveness and bolster Disney’s ongoing transformation endeavors.

Here’s Why They Are Spending Millions

These parties are spending money on marketing materials, extensive social media campaigns, and hiring proxy solicitors to obtain shareholder support for the board candidates they represent.

The main reason behind the substantial expenditure by these parties is that a large number of individual investors own Disney stock. Their collective ownership represents over a third of Disney’s stock. Moreover, institutional investors such as BlackRock and Vanguard hold the remaining shares, wielding significant influence. Effectively communicating with this diverse shareholder base entails substantial financial costs.

With this backdrop, let’s delve into its ownership structure.

Digging into Disney’s Ownership Structure

According to TipRanks’ ownership page, public companies and individual investors own 50.44% of DIS. They are followed by other institutional investors, mutual funds, and insiders at 25.10%, 16.05%, and 8.41%, respectively.

Looking closely at institutions (Mutual Funds and Other Institutional Investors), Vanguard owns a 7.23% stake in Disney stock. Next up is Vanguard Index Funds, which holds a 6.48% stake in the company.

Is Disney a Good Buy Right Now?

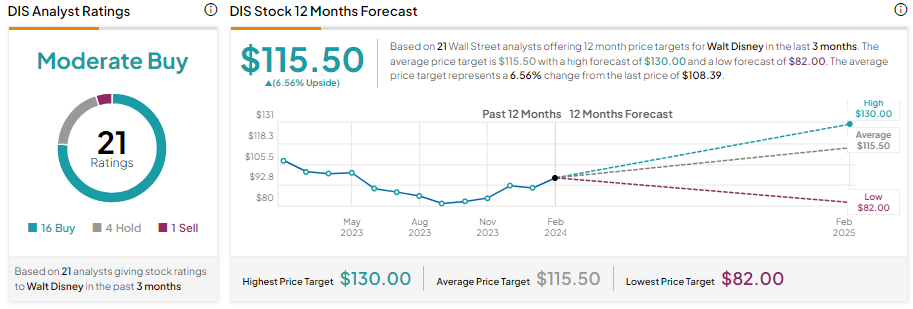

Disney stock is up approximately 1% in one year, underperforming the S&P 500’s (SPX) gain of 21.5%. Meanwhile, analysts are cautiously optimistic about its prospects. DIS stock has 16 Buy, four Hold, and one Sell recommendations for a Moderate Buy consensus rating. Analysts’ average DIS stock price target of $115.50 implies a limited upside potential of 6.56% from current levels.