The battle between entertainment giant Disney (NYSE:DIS) and activist investors regarding the restructuring of its Board continues. In a recent development, Blackwells Capital, an activist hedge fund and DIS shareholder, has submitted an initial proxy statement with the SEC, seeking endorsement for its three proposed candidates to join Disney’s Board of Directors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Blackwells emphasized that its nominees would significantly contribute to the Board’s improvement and support Disney’s ongoing transformation efforts. Further, Jason Aintabi, Blackwells’ Chief Investment Officer (CIO), expressed disappointment over Disney’s decision to engage in an information-sharing agreement with ValueAct, another activist investor. Aintabi insisted that Disney should disclose all information shared with ValueAct to other shareholders.

This comes after activist investor Nelson Peltz officially launched a proxy fight against Disney last week. Peltz’s Trian Fund Management, holding around $3 billion worth of Disney stock, has put forth two independent director candidates, including Peltz himself and former Disney CFO James Rasulo, for election to the Disney Board of Directors. Notably, Disney recently announced 12 nominees to add to its board. Moreover, it did not endorse the nominations put forward by Trian and Blackwells Capital.

Is Disney Stock a Good Buy Now?

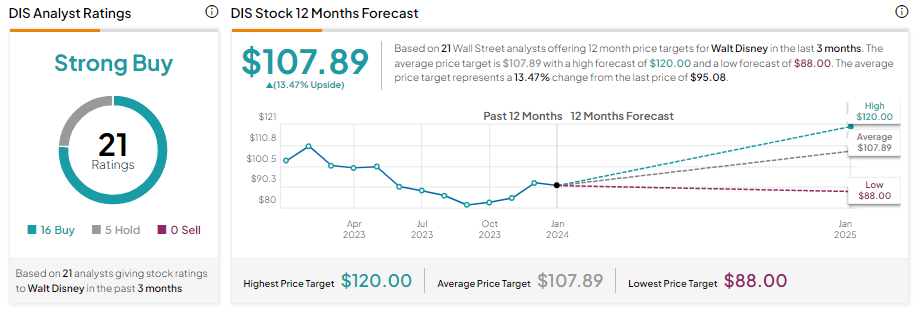

While Disney is engaged in a battle over the restructuring of its board, it is focusing on improving its financial performance. Wall Street analysts are showing faith in Disney’s turnaround efforts, as reflected through their bullish outlook.

DIS stock has 16 Buy and five Hold recommendations for a Strong Buy consensus rating. Disney stock is down about 10% in one year, underperforming the S&P 500’s (SPX) gain of over 20%. Analysts’ average DIS stock price target of $107.89 implies 13.47% upside potential from current levels.