Rhode Island-based CVS Health Corporation (NYSE: CVS) is a well-established healthcare company in the U.S. The company owns CVS Pharmacy-a retail pharmacy chain, CVS Caremark-a pharmacy benefits manager, and Atena-a health insurance provider, among many other brands. Over the years, it has transformed into a full-service healthcare company and owns more than 9,900 stores.

Interestingly, the company has excelled in virtual and digital health offerings, by lowering the cost of care for consumers.

CVS Health has posted better-than-expected first-quarter 2022 results. Additionally, it provided a strong updated outlook. Following the news, shares of the healthcare company rose 4.78% to close at $100.57 on Wednesday.

Results in Detail

CVS Health registered adjusted earnings of $2.22 per share, topping Street’s estimates of $2.15 per share. The company reported adjusted earnings of $2.04 per share in the same quarter last year.

In other positive news, revenues surged 11.2% year-over-year to $76.83 billion and came well ahead of analysts’ expectations of $75.39 billion. Growth across all segments drove the results.

Segment-wise, Health Care Benefits recorded revenues of $23.1 billion, up 12.8% year-over-year, while revenues at Pharmacy Services jumped 8.6% to $39.5 billion. Additionally, Retail/LTC revenues came in at $25.4 billion, up 9.2%.

During the quarter, the company administered more than six million COVID-19 tests and over eight million COVID-19 vaccines in the U.S.

Outlook

Encouraged by reported results, for 2022, the company projects revised adjusted EPS to be in a range of $8.20 to $8.40 per share, up from the prior guidance range of $8.10 to $8.30 per share. The consensus estimate stands at $8.27.

Cash flow from operations is anticipated to be in the range of $12 billion to $13 billion. Additionally, capital expenditures are likely in the range of $2.8 billion to $3 billion on increased investments in technology and digital enhancements.

During the earnings call, the CFO of CVS Health, Shawn M. Guertin, said, “As we evaluate the progression of earnings for the remainder of the year, we would remind investors of our prior statements that we expect 2022 earnings to be modestly higher in the first half of the year. Similar to 2021 earnings progression, we currently project that 47% to 49% of adjusted EPS will occur in the back half of 2022, which we project will be fairly evenly split between the third and fourth quarters.”

Capital Deployment

During the quarter, CVS Health increased its quarterly dividend by 10% effective February 1, 2022, and returned $722 million to shareholders in the form of dividends. Additionally, it repurchased about 19.1 million shares of common stock. This marks the company’s first repurchase of stock since 2017.

Wall Street’s Take

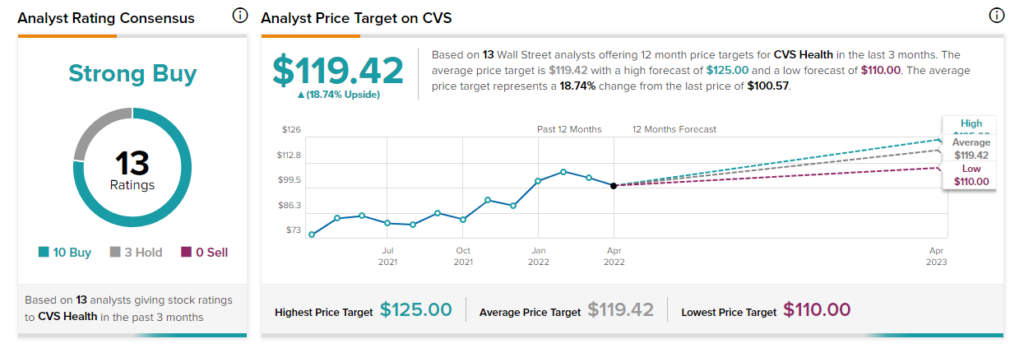

Consensus among analysts is a Strong Buy, based on 10 Buys and three Holds. The average CVS Health price target stands at $119.42 and implies upside potential of about 18.74% to current levels. Shares have increased 23.85% over the past year.

Investor Wisdom

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on CVS Health, with 2.5% of investors maintaining portfolios on TipRanks increasing their exposure to CVS stock over the past 30 days. Furthermore, 0.9% of these individuals have increased their holdings in the recent week.

Ending Remarks

With strong results, encouraging outlook, recent stock price performance, and high analyst ratings, investors might consider adding CVS Health to their portfolio to reap potential long-term gains.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Devon: Pumping Out Strong Q1 Earnings and Capital Deployment

Spirit Airlines Flies High with Frontier, JetBlue Deal Nosedives

Tesla: Shanghai Production Ratcheted up to 80% Capacity