The last two months or so have been a disaster for cryptocurrency funds—and crypto stocks in many cases by extension—all over the spectrum. However, the latest week proved a winner, as a massive new inflow delivered a turnaround so profound it actually reset weeks of losses. The biggest news that drove such a move came from Bitcoin (BTC-USD) itself, which gained nearly 8% as institutional investors came back to the table. $199 million came flooding back into the market. That was enough to not only make up for just over four of the last sets of outflows but also represented the single biggest week of cash coming back into play since July 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What actually drove this recent massive influx of interest and, by extension, cash? A report from CoinShares noted that “…recent announcements from high profile ETP issuers that have filed for physically backed ETFs with the US Securities & Exchange Commission” expressed sufficient “positive sentiment” to draw buyers back to the table. It wasn’t just Bitcoin seeing gains, either; Ripple (XRP-USD) saw $240,000 come in last week, and that was in spite of a decline over the previous week’s price. Meanwhile, Ethereum (ETH-USD) saw $7.8 million come in by itself. That does suggest a reduced appetite for Ethereum, even at lower prices.

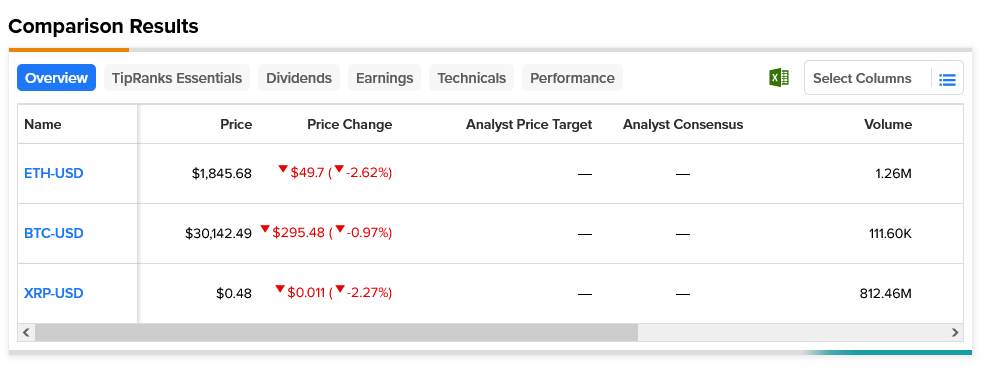

All three major cryptocurrencies mentioned—Bitcoin, Ethereum, and Ripple—were down in Monday afternoon’s trading. However, Bitcoin was down the least at just 0.97% while maintaining that psychologically-critical level of just over $30,000 per coin.