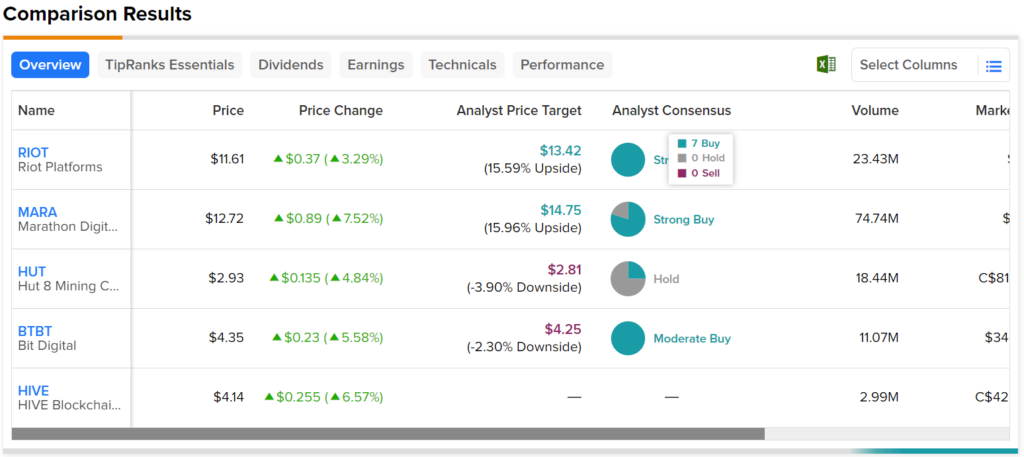

Shares of Marathon Digital Holdings (NASDAQ: MARA) are higher at the time of writing, which can be attributed to Bitcoin’s (BTC-USD) surge that’s boosting crypto-related stocks. Bitcoin’s notable rally, reaching as high as $31,443.17 during the past 24 hours, also led to substantial weekly gains for other Bitcoin miners, including:

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Riot Platforms (NASDAQ: RIOT)

- Hut 8 Mining (NASDAQ: HUT)

- HIVE Blockchain (NASDAQ: HIVE)

- Bit Digital (NASDAQ: BTBT)

As Marathon operates by mining Bitcoin at third-party hosting facilities, its profitability is primarily reliant on the price of Bitcoin and electricity costs, thereby linking the company’s stock price closely to that of Bitcoin.

Overall, it appears that Wall Street has the highest expectations from MARA stock. Indeed, analysts anticipate almost 16% upside potential thanks to its average price target of $14.75.