Eli Lilly & Co. has entered into an agreement with the Bill & Melinda Gates Foundation, for future supply of the US drugmaker’s therapeutic Covid-19 antibody candidates to low- and middle-income countries.

The agreement to bring equitable access to potential treatments is part of the Covid-19 Therapeutics Accelerator, an initiative launched by the Gates Foundation, Wellcome, and Mastercard to speed up the development of Covid-19 therapies.

Lilly (LLY) said that commercial manufacturing will commence in April 2021 at the FUJIFILM Diosynth Biotechnologies facility in Denmark without providing information on the number of doses. The Gates Foundation based its decision to collaborate with Lilly for the manufacturing capacity on pre-set criteria, including available information regarding safety, efficacy and ability to implement in lower-resource settings.

Therapeutic antibodies have the potential to prevent and treat Covid-19, reducing the burden on healthcare systems worldwide, Lilly said. In an effort of making the supply of Covid-19 therapeutic treatments available globally as quickly as possible, Lilly will make certain volumes of its antibody therapeutic manufactured in other facilities available to lower-income countries prior to April 2021, pending the timing of regulatory authorization.

As part of the agreement, Lilly and its partners will continue to be responsible for research and development of the therapeutic treatments. Furthermore, Lilly’s partners, AbCellera Biologics, Shanghai Junshi Biosciences and Columbia University have agreed to waive their royalties on the US drugmaker’s therapeutic antibodies distributed in low- and middle-income countries.

“Medicines that can help reduce the impact of Covid-19 will be an important part of the solution to this pandemic and are urgently needed by people all over the world,” said Lilly’s CEO David A. Ricks. “Lilly is proud to be a part of the collective global effort to help ensure equitable access to Covid-19 therapeutic options for people in low- and middle-income countries.”

Earlier this month, Lilly announced that it has applied for emergency use authorization (EUA) for one of its Covid-19 antibody candidates, LY-CoV555, as a monotherapy for higher risk patients with mild-to-moderate symptoms. The company also presented new interim trial data for the combination therapy of LY-CoV555 and another antibody, LY-CoV016.

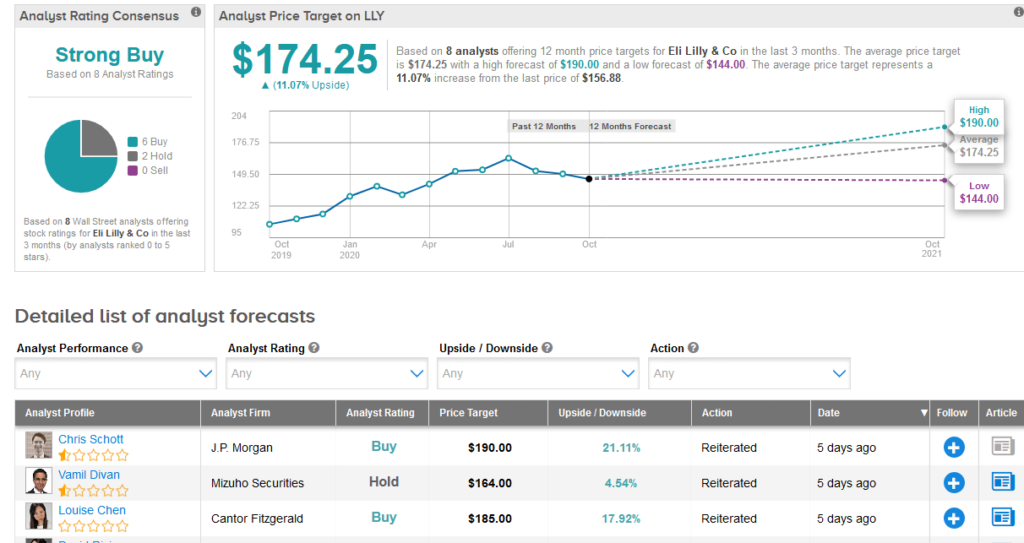

While, Mizuho analyst Vamil Divan views the new data as “promising,” the analyst believes the “clinical meaningfulness of some datapoints remains up for debate.” Divan reiterated a Hold rating on the stock with a $164 price target.

“We wonder where the combination would fall in the Covid treatment algorithm, how/where patients would receive it, and how Lilly may price the therapy, but overall find today’s data release encouraging,” Divan wrote in a note to investors on Oct. 7. (See Eli Lilly’s stock analysis on TipRanks).

Shares in LLY are up more than 19% year-to-date and the stock scores a bullish Strong Buy Street consensus. That’s with a $174.25 average analyst price target, indicating 11% upside potential lies ahead.

Related News:

CareDx Soars 15% As 3Q Revenue Outlook Surpasses Estimates

BioNTech, Rentschler Partner For Covid-19 Vaccine Manufacturing

Gilead Inks EU Supply Deal For 500,000 Remdesivir Doses