The shares of data streaming software maker Confluent (CFLT) accelerated on Wednesday morning after reports emerged it was considering buyout offers from private equity firms and top technology companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CFLT stock jumped over 10% to about $23 per share as of 11:34 a.m. Similarly, the stock soared by almost 15% during early trading on Wednesday.

According to a Reuters report, the company has teamed up with an investment bank to explore a potential sale of its business. Confluent builds software that enables businesses to process and manage their data in real-time.

These features are critical to modern businesses, especially those that need real-time integrated solutions to power artificial intelligence efforts. The potential deal comes at a time when investments into AI have risen sky-high, sparking fears of a bubble.

Raymond James Sees 30% Acquisition Premium

Confluent’s openness to be acquired comes at a challenging time for the company. Despite its shares adding 12% on Monday morning, CFLT stock has dropped over 18% since the start of the year, as the company reportedly lost a major customer earlier in July.

However, Raymond James analyst Mark Cash believes that Confluent still had the ability to be acquired at a 30% premium because of its strategic importance in the data and AI ecosystem. Cash also cited Confluent’s technology and growth potentials as reasons for seeing that the company could be bought beyond its current market value.

Furthermore, the analyst noted that experts had earlier foreseen the company being taken over due to its valuation multiple compression–that is, investors had been paying less for each unit of its earnings and sales.

Meanwhile, no deal has been finalized yet with regards to the buyout offers, according to media reports.

Businesses Consolidate and Ramp Up AI Deals

Reports about Confluent’s possible acquisition move come as consolidation efforts have kicked off in the data software sector, with Salesforce (CRM) recently agreeing to take over Informatica (INFA), a cloud data management business, in a $8 billion deal.

However, deal-making amid the ongoing AI surge is much broader, even as agentic coding–which goes beyond generative AI to make artificial intelligence an ‘agent’ that can handle several tasks– is seen as fueling the latest AI boom.

In recent weeks, Softbank (SFTBY) has aimed to extend its AI reach with a $5.4 billion robotics deal, while asset manager BlackRock (BLK) is looking to acquire Aligned Data Centre, the Texas-based company that designs and builds data centers in a $40 billion deal.

In the latest on the parts of firms directly empowering the AI boom, American chip designer Advanced Micro Devices (AMD) this week shook hands with AI startup OpenAI on a deal to deliver up to 6 gigawatts of AI infrastructure.

Is Confluent a Good Stock to Buy?

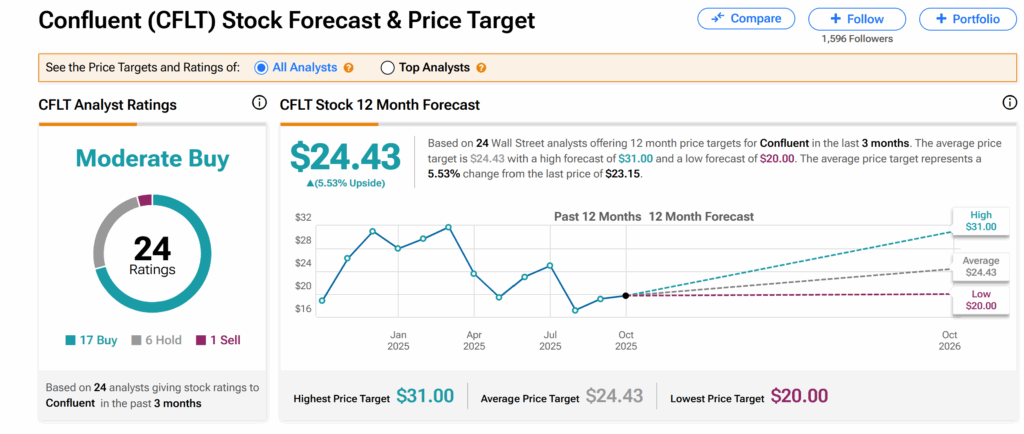

However, on Wall Street, Confluent’s shares currently have a Moderate Buy consensus recommendation. This is based on 17 Buys, six Holds, and one Sell assigned by 24 Wall Street analysts over the past three months.

Furthermore, the average CFLT price target of $24.43 suggests a 5.53% growth potential from its current price.