Three years ago, ChatGPT marked the beginning of the generative AI era – artificial intelligence that could hold natural, real-time conversations. Over time, it grew more versatile, learning to organize and summarize web information, translate languages, and produce well-crafted text in seconds.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It evolved into agentic AI, AI as an agent, capable of handling tasks autonomously. This was AI that we could set to a task – tell it what to do, and let go. It could handle customer contacts, analyze data, and automate repetitive tasks.

And now there’s agentic coding. This is AI that can build AI. We can set up agentic coding using plain-text prompts, and the AI will devise the code to create the agent. It’s AI that understands what we want and how to get it done.

As Wells Fargo analyst Ryan MacWilliams puts it, the market impact is only starting to be felt: “Investors underestimating how the launch of agentic coding in Feb. 2025 has led to a wave of new AI development. Agentic coding automates AI agent builds, and drives significant coding productivity. Buy infrastructure SaaS, the AI build cycle is on.”

Against this backdrop, MacWilliams is recommending three stocks that are poised to benefit from a new AI boom. All three are linked to agentic AI and coding, and according to the TipRanks database, all three have Strong Buy ratings from the Street. Here are the details on these Wells Fargo AI picks.

HubSpot, Inc. (HUBS)

We’ll start with a look at the marketing software platform HubSpot. HubSpot has been in business since 2006, and has become one of the online marketing world’s go-to software platforms. The company offers its customers a set of cloud-based digital marketing tools purpose-built to solve the day-to-day issues that face marketers in fields like CRM, social media, content management, and the old stand-by, SEO. HubSpot’s unified platform is popular with inbound sales teams, direct marketers, and customer service experts.

HubSpot built its reputation on the innovative nature of its toolset. Users could automate a wide range of marketing functions, optimize ad placement, build newsletters and publish content, even build chatbots. In recent years, these tasks have proven highly amenable to AI enhancement, and HubSpot was quick to see that potential. The company developed Breeze, its AI assistant designed to work within the HubSpot platform.

Most importantly, HubSpot is using recent advances in agentic AI to allow users to build or modify their own AI tools. These include customer agents, but the company has an array of new features in late stages of development. Prospecting agents, closing agents, personalization agents, data agents – all of these features are coming into play with HubSpot, to give users more flexibility in approaching online marketing. The key point – the agents will handle the time-consuming ‘busy work,’ allowing the human behind the scenes to make better decisions based on more accurate data in real time.

Like many online subscription services, HubSpot operates on the ‘freemium’ model, giving its registered users an array of basic tools free of charge while reserving the more advanced features for paid subscribers. The model has proven successful; many users are satisfied with the free tools, and their use of HubSpot provides a base for word-of-mouth advertising, while the subscription users provide the company with a sound financial base.

HubSpot last reported financial results for 2Q25, and in that period showed a top line of $760.9 million. This was up 19% year-over-year and came in $20.8 million better than had been expected. The company’s success was driven by its subscription revenue, which at $744.5 million was up 19% year-over-year. HubSpot’s earnings, $2.19 per share by non-GAAP measures, were 7 cents per share better than had been forecast, and the company had $1.9 billion in liquid assets available at the end of Q2.

We should note here that HubSpot’s stock is down right now, showing a 35% year-to-date loss. The most recent hit to the stock came last week, when OpenAI, the creator of ChatGPT, announced a new set of software tools for marketing and customer contact use. This represents a direct challenge to companies like HubSpot – although HubSpot, which has been working on AI features for over a year now, has the resources to meet such a challenge.

That is the view of Ryan MacWilliams. In his write-up of HubSpot for Wells Fargo, the analyst notes that the company has proven capable of developing quality tools on a fast timeline, and that gives it an advantage in a challenging environment. MacWilliams writes, “Our working thesis is that HUBS can add agentic use cases in a reasonable period before a competitor gets to comparable scale/breadth of the platform. HubSpot’s installed base, customer data, and partner ecosystem give it a leg up on distrubution/integrations out of the gate. While there will certainly be heightened competition as entrants try to build new agentic solutions, we believe HUBS is attractively positioned to monetize agentic AI (and power users) at scale.”

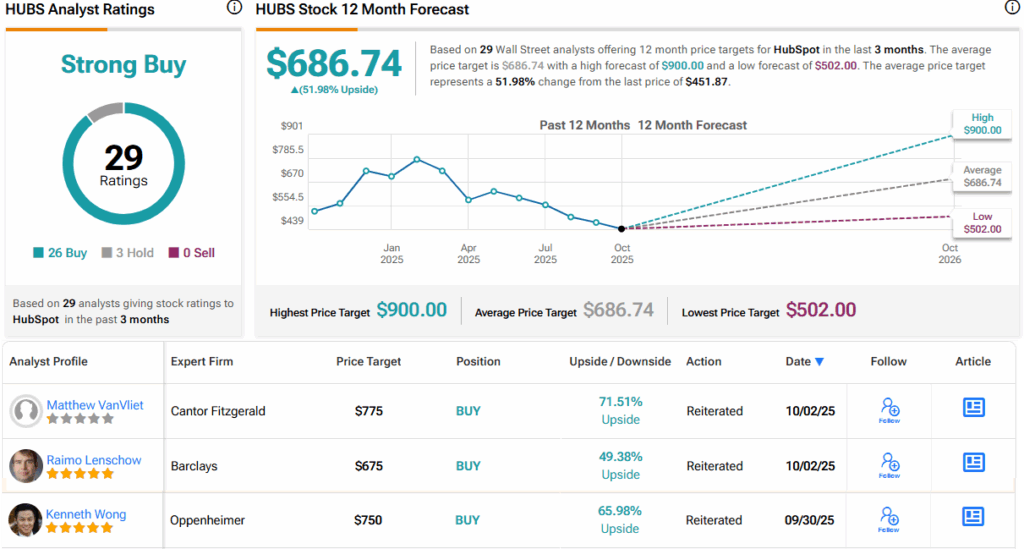

MacWilliams goes on to rate HUBS as Overweight (i.e., Buy), and gives the stock a $685 price target that suggests a one-year upside potential of 51.5%. (To watch MacWilliams’ track record, click here)

HubSpot’s Strong Buy consensus rating is based on 29 analyst reviews that include 26 Buys against 3 Holds. The shares are priced at $451.87, and their $686.74 average target price implies a 52% gain in the year to come. (See HUBS stock forecast)

Atlassian Corporation (TEAM)

The next stock on our radar here is Atlassian, an international software company (Australia and the US) with 23 years’ experience in designing and building office collaboration tools. The company offers subscribers a set of software packages designed to link office teams together, to enhance their ability to coordinate and collaborate, and to improve efficiency and creativity in the workplace.

Atlassian’s flagship product, for which it is best known, is Jira, a project management tool that allows supervisors and workers to assign, monitor, and track work projects from concept to completion. Over the years, Atlassian has expanded on the popularity of Jira, and today offers its customers a full stable of software programs and tools, specialized for everything from increasing teamwork and collaboration to promoting online security. And, among the features that Atlassian’s tools can handle are both AI and coding.

The company’s Rovo Dev is an agentic AI tool designed to help users build high-end software quickly, without sacrificing quality. Atlassian boasts that Rovo Dev can turn any user’s terminal into an AI development agent, capable of understanding, coding, and collaborating to bring AI development into the work team. Features include the code planner, code reviewer, deployment summarizer, and pipeline troubleshooter, all built with the assistance of AI agents.

In addition to its in-house array of AI tools, Atlassian is also making moves to expand through acquisition. Last month, the company took steps in this direction. It announced, on September 4, that it had entered an agreement to acquire The Browser Company, the New York-based firm that builds browsers for the AI-powered world. Atlassian will purchase The Browser Company for $610 million in cash.

The second move was announced on September 18, when Atlassian made public its intention to acquire the engineering intelligence firm DX. This move will bring DX’s capabilities and knowledge to bear on Atlassian’s array of AI-powered collaboration tools. The DX acquisition will be conducted in both cash and stock, for approximately $1 billion. Both this acquisition and that of The Browser Company above are expected to close during 2Q26.

In the most recent quarterly report, which covered fiscal 4Q25, TEAM beat expectations on both the top and bottom line.Atlassian reported fiscal 4Q revenue of $1.38 billion, up 23% year-over-year and $30 million better than had been anticipated. At the bottom line, the company’s 98-cent non-GAAP EPS was 13 cents better than the estimates.

The Wells Fargo team is upbeat on Atlassian, citing the company’s combination of a strong customer base, opportunity for growth, and attractive pricing. Analyst MacWilliams writes, “Our positive outlook on TEAM is driven by strong pricing, under penetrated upsell/crosssell opportunity, cloud migrations, and AI platform opportunity… TEAM’s position in the enterprise stack provides them an opportunity to serve as the orchestration center where non-technical users and developers can organize/create AI features+agents. Here TEAM acts as the control tower for development and AI projects across an organization. This position, coupled with faster cloud migrations and the cross-sell and upsell opportunity lead us to believe the durability of TEAM’s growth algorithm.”

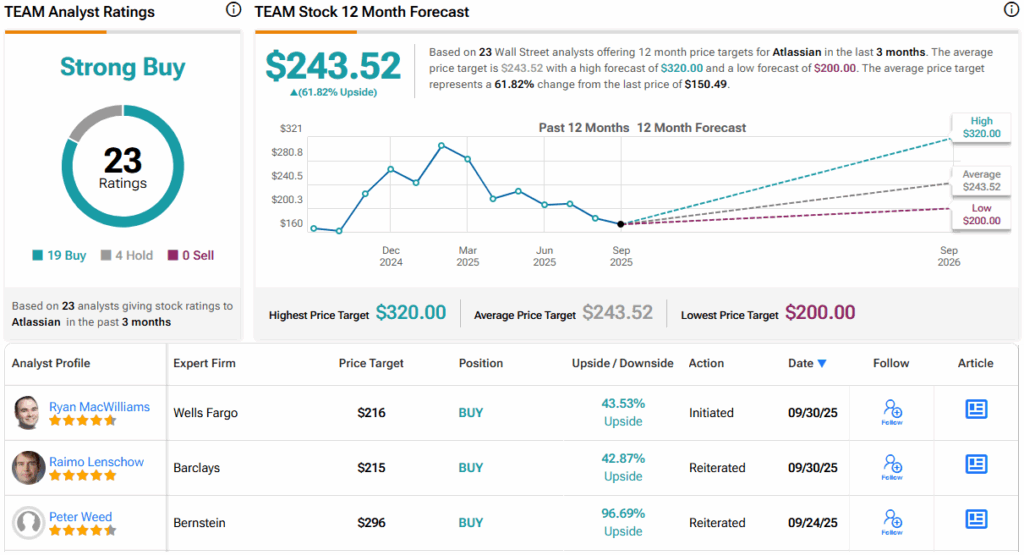

These comments back up the Overweight (i.e., Buy) rating here, while the analyst’s $216 price target points toward a one-year gain of 43.5%.

There are 23 recent analyst reviews on record for Atlassian’s stock, and the 19-to-4 breakdown, favoring Buy over Hold, supports the Strong Buy consensus rating. The shares are priced at $150.49 and have an average price target of $243.52, suggesting an upside of 62% for the next 12 months. (See TEAM stock forecast)

Braze (BRZE)

Last up is Braze, a software company with a focus on customer engagement for enterprise clients. The company offers its client base a multi-channel, cloud-based marketing platform that allows users to prioritize conversations, building relationships with a target audience as a long-term driver for sales. The Braze platform is designed to help move the potential customer from information to buying, at whatever pace best fits the customer.

This approach is data-driven, and the Braze platform is built to draw that data from a diverse array of sources. This is the wide top of the funnel, and the company’s enterprise clients use it to engage with their customers, encouraging them to move down the sales funnel through cross-channel messaging that delivers accurate, data-driven information based on real-time analysis. This approach is naturally amenable to the use of AI, in a variety of ways, and Braze boasts that its use of AI is ‘rewriting the rules of customer engagement.’

BrazeAI, the company’s AI-powered platform, is designed to amplify the user’s efforts, making marketing work more relevant in today’s fast-evolving tech scene. The AI is designed to create relevant messages, personalized content, and recommendations that lead toward optimal end results. The Braze AI platform automates a large part of the marketing process, allowing for faster responses to customer needs and requests and stronger engagement – leading to a more relevant and successful sales funnel.

What this means for investors is that Braze has built a solid foundation based on quality products and has proven that it can make use of the latest in AI tech. The company has attracted a customer base of top-tier names, including Venmo, Kentucky Fried Chicken, HBOMax, and Yelp. The Braze platform handled 3.9 trillion messages and other actions in 2024 and had a monthly active user base more than 7.4 billion strong. Braze boasted 2,422 enterprise clients as of July 31 this year.

In its fiscal 2Q26 report, the last released, Braze’s quarterly revenue came to $180.1 million, for a 24% year-over-year gain – and an $8.5 million beat compared to expectations. The company realized 15 cents per share in non-GAAP earnings, beating the forecast by 12 cents per share.

We’ll check in one last time with Wells Fargo and analyst Ryan MacWilliams, who sees agentic AI as the key to Braze’s continued strength. The analyst writes of Braze, “Agentic AI advancements and new use cases raise marketing velocity, resulting in more campaigns, messages, triggers, and channels. More complexity is where BRZE excels, as its enterprise customer focus (~62% of ARR) includes the most sophisticated B2C marketing programs. In our view, BRZE is positioned to reap the benefits of an increasingly AI world as more brands utilize BRZE to get an edge with customers.”

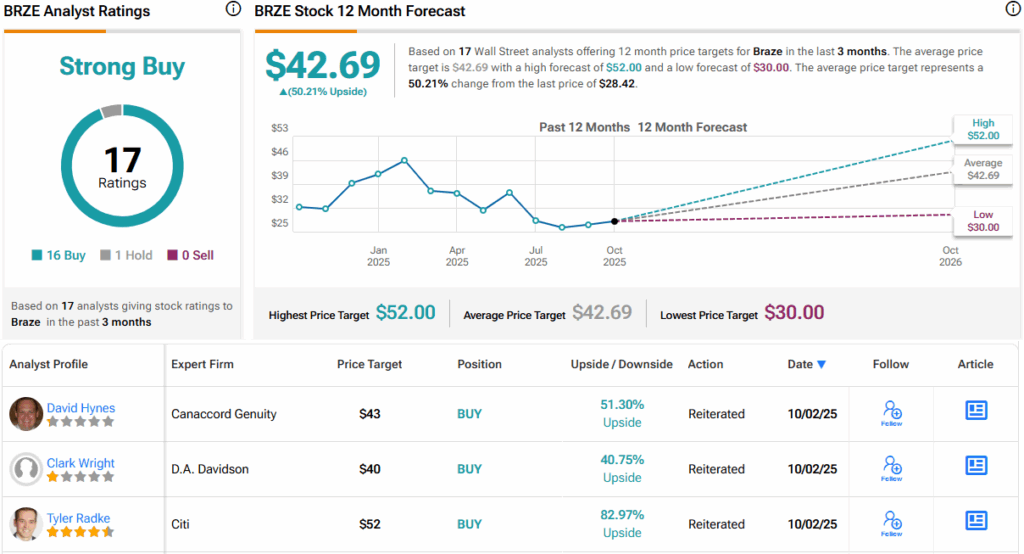

MacWilliams follows this with an Overweight (i.e., Buy) rating on BRZE, along with a $40 price target that implies an upside of 41% on the one-year horizon.

Braze’s Strong Buy consensus rating is based on 16 unanimously positive analyst reviews. The shares have a current trading price of $28.42, and their $43.53 average target price suggests that the stock will gain 53% by this time next year. (See BRZE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.