Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

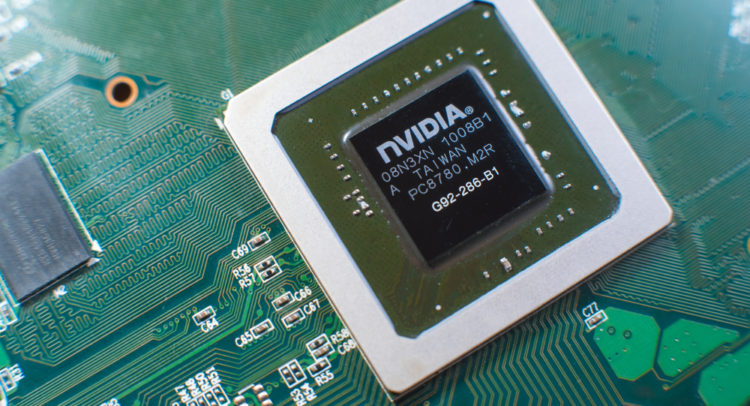

Penn Davis Mcfarland Inc, managed by R. Van Ogden, recently executed a significant transaction involving Nvidia Corporation ((NVDA)). The hedge fund reduced its position by 22,385 shares.

Spark’s Take on NVDA Stock

According to Spark, TipRanks’ AI Analyst, NVDA is a Outperform.

Nvidia’s strong financial performance and positive earnings call are the most significant factors driving the score. The company’s robust revenue growth and profitability, along with strategic positioning in AI infrastructure, support a high score. However, high valuation metrics and geopolitical risks slightly temper the overall outlook.

To see Spark’s full report on NVDA stock, click here.

More about Nvidia Corporation

YTD Price Performance: 34.93%

Average Trading Volume: 173,465,664

Current Market Cap: $4438.2B

Trending Articles:

- RTO Doesn’t Always Mean RTO: Microsoft Stock (NASDAQ:MSFT) Notches Up as Salespeople Find Exemption

- This Was Not the First Bid: Warner Bros. Discovery Stock (NASDAQ:WBD) Gains as it Rejected Three Bids from Paramount So Far

- ‘Paramount Can Walk Away with Warner Bros.’ Say TD Cowen and Benchmark Analysts