American beverage king Coca-Cola Co. (KO) recorded an excellent start to 2022 with first-quarter results that beat both earnings and revenue expectations.

Shares reached a new all-year high on the news before settling down around $65 per share.

Q1 Results in Detail

For the three months ended April 1, 2022, Coca-Cola’s revenues jumped 16% year-over-year to $10.49 billion and surpassed the Street estimates of $9.83 billion. The solid growth was driven by a 7% rise in price/mix and an 11% increase in concentrate sales.

Similarly, adjusted earnings rose 16% year-over-year to $0.64 per share and also came in six cents higher than the consensus.

FY 2022 Outlook

Coca-Cola has stopped all operations in Russia following its untimely attack on Ukraine. For the full-year 2022, this step is expected to have a 1% impact on unit case volumes, 1%-2% impact on net revenues and operating income, and a $0.04 impact on adjusted earnings.

For FY 22, Coca-Cola forecasts adjusted earnings to grow between 5%-6% over FY 21 adjusted earnings of $2.32 per share. Moreover, free cash flows are expected to reach $10.5 billion in 2022.

On an organic basis, full-year revenues are projected to grow by 7%-8% in Fiscal 2022.

Executive Comments

Delighted with the company’s performance, James Quincey, chairman and CEO said, “We are pleased with our first-quarter results as our company continues to execute effectively in a highly dynamic and uncertain operating environment… We are confident in our full-year guidance, and we are well-equipped to win in all types of environments as we fuel strong topline momentum and create value for our stakeholders.”

Wall Street’s Take

Following Coca-Cola’s healthy results, Cowen & Co. analyst Vivien Azer lifted the price target on the KO stock to $68 (3.2% upside potential) from $65 while maintaining a Hold rating.

The five-star analyst is particularly encouraged by Coca-Cola’s earnings beat and organic revenue growth of 18%, which compared easily to the subdued results of the same period last year.

The other analysts on the Street are cautiously optimistic about KO stock with a Moderate Buy consensus rating based on 12 Buys and five Holds. The average Coca-Cola price forecast of $69.72 implies 5.9% upside potential to current levels. The stock has gained a little over 12% year-to-date.

Stock Investors

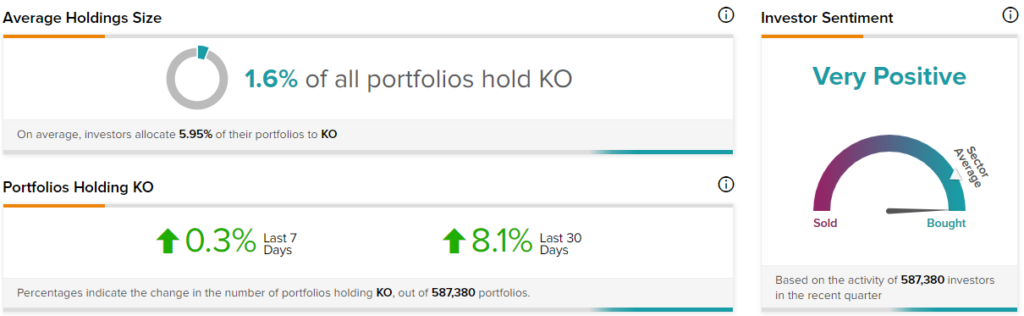

On the brighter side, TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Coca-Cola, with 8.1% of portfolios tracked by TipRanks increasing their exposure to KO stock over the past 30 days.

Ending Notes

Coca-Cola has become more of a habit than just a drink for millions of people worldwide. Even with the current inflationary environment, there may just be a slight pullback in the consumption of the beverages against a complete halt.

All in all, analyst views of the stock compared with a strong investor vote bode positively in favor of the beverage king.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Firms Eye Bed Bath & Beyond’s Buybuy Baby Unit; Shares Surge

Airlines Adopt Unique Ways to Survive Pilot Shortage

Does Musk-Twitter Saga Favor Tesla CEO?