Citigroup (C) is facing a revived $1 billion lawsuit for allegedly duping investors of more than $1 billion in losses in a nine-year-old case. According to the newly reinstated lawsuit, Citigroup allegedly provided $3.3 billion to Mexican oil drilling company, Oceanografia between 2008 and 2014, despite knowing that it forged signatures and had huge debt.

A three-judge panel of the 11th U.S. Circuit Court of Appeals in Miami found that the plaintiffs, including 30 Oceanografia vendors, creditors and bondholders, had adequately proven that Citigroup knowingly aided the fraud. The court also ruled yesterday that the previous dismissal of the case by a lower court judge was erroneous.

Background of the Revived Lawsuit

Oceanografia is now bankrupt, but back then, it provided oil drilling services to Mexico’s state-owned oil company Petroleos Mexicanos (Pemex). Citigroup’s Mexican unit, Banamex, continued to make cash advances to Oceanografia, even though it had full knowledge of the company’s financial burdens. Oceanografia is also accused of forging Pemex’s signature on official documents for availing the loans. The lawsuit alleges that Banamex continued funding in lieu of the hefty interest payments generated from the loans.

Notably, Banamex later found nearly $430 million of faulty cash advances and was fined $4.75 million by the U.S. Securities and Exchange Commission (SEC) in 2018 for its inadequate internal controls. Moreover, the bank fired 12 employees and found that 10 of them were criminally liable under Mexican law for the fraud.

Importantly, if the revived lawsuit and subsequent trials find Citigroup liable, it could face up to $1 billion in fines, having massive financial implications for one of the world’s largest financial institutions.

Is Citigroup a Buy, Hold, or Sell?

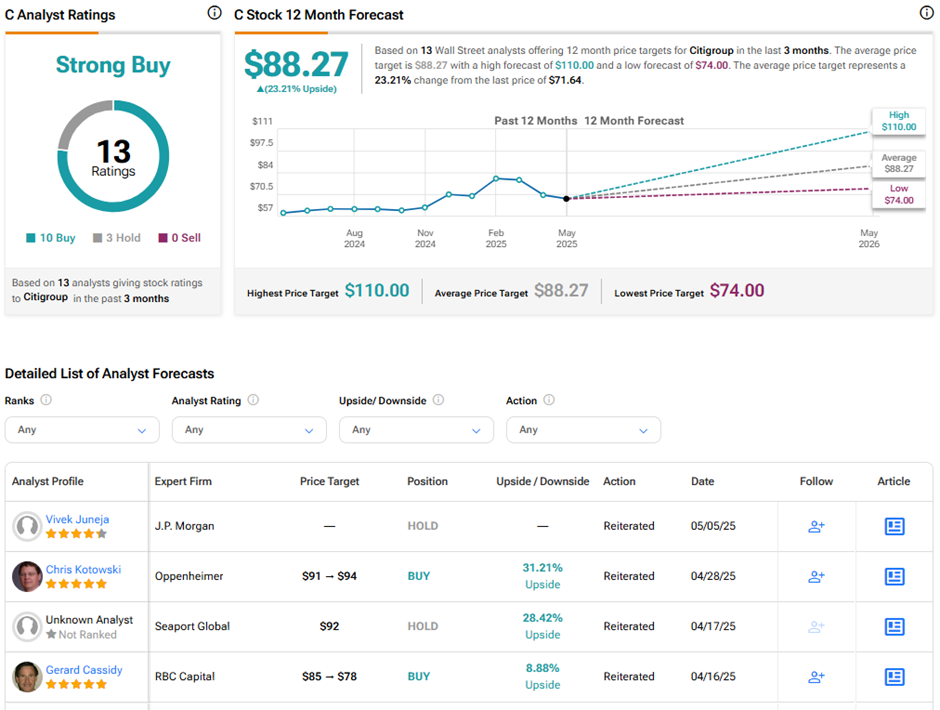

Following its blockbuster Q1FY25 results, analysts remain highly optimistic about Citigroup’s long-term stock trajectory. On TipRanks, C stock has a Strong Buy consensus rating based on 10 Buys and three Hold ratings. Also, the average Citigroup price target of $88.27 implies 23.2% upside potential from current levels. Year-to-date, C stock has gained 3.3%.