For the last year now, Citigroup (NYSE:C) has been trying, without success, to sell off Banamex, its Mexico arm. After 16 full months of trying, the process has gone nowhere, and that’s left Citigroup stock down somewhat in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With a sale now largely a failure and Citigroup left blaming the President of Mexico himself for the latest setbacks, Citigroup is left to take Banamex and make it its own operation. That’s a process that will likely take just over a year to complete, with the initial public offering set to launch in 2025. Though it’s not yet clear where Banamex will be listed, CNBC noted that a simultaneous listing in the U.S. and Mexico was entirely possible.

So what role did Mexico’s president, Andres Manuel Lopez Obrador, play in the Citigroup move? A Wall Street Journal report noted that, for a while, the Mexican government was considering buying Banamex itself. Since Banamex was the fourth-largest bank in Mexico, the Mexican government taking a stake therein to keep it operational had at least some connection to national security. Some were concerned about the Mexican government taking such a stake, but the matter seems to be moot now as Citigroup is spinning off Banamex instead.

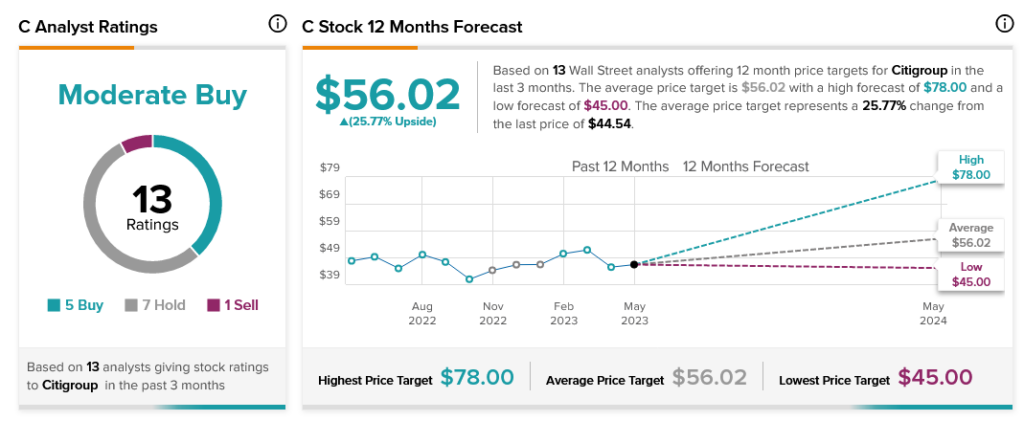

Though the move hit Citigroup in Wednesday’s trading, analysts are still largely on Citigroup’s side. With five Buy ratings, seven Holds, and one Sell, analyst consensus calls Citigroup stock a Moderate Buy. Further, it offers investors 25.77% upside potential thanks to an average price target of $56.02.