China is aiming to grow its GDP by about 5% this year. The ambitious target demonstrates confidence among the country’s leaders at a time when its economy is in the doldrums. The announcement, though, has largely failed to translate into major price gains in top Chinese stocks such as Alibaba (NYSE:BABA), JD (NASDAQ:JD), and Bilibili (NASDAQ:BILI) today.

Last year, an anticipated bounce-back in China’s economy following its post-COVID-19-opening largely failed to live up to expectations. The SHANGHAI Composite Index (SHCOMP) slumped from nearly 3,400 in May 2023 to a low of about 2,700 last month.

However, the Chinese leadership has undertaken necessary (sometimes seemingly forceful) measures to keep the country’s growth engine humming. The SHCOMP has rallied by nearly 12% over the past month after Chinese authorities swiftly moved to stem a freefall in the country’s financial markets. Additionally, China is increasing its military spending by 7.2% to nearly $232 billion, according to the Wall Street Journal.

The 5% goal seems ambitious due to multiple headwinds, such as mounting pressure in its property market, weak consumer demand, worsening demographic trends, and trade tensions with the West. Consequently, traders will now keep an eye on further details about the country’s next steps surrounding policy plans and actions.

What Are the Best Chinese Stocks to Buy?

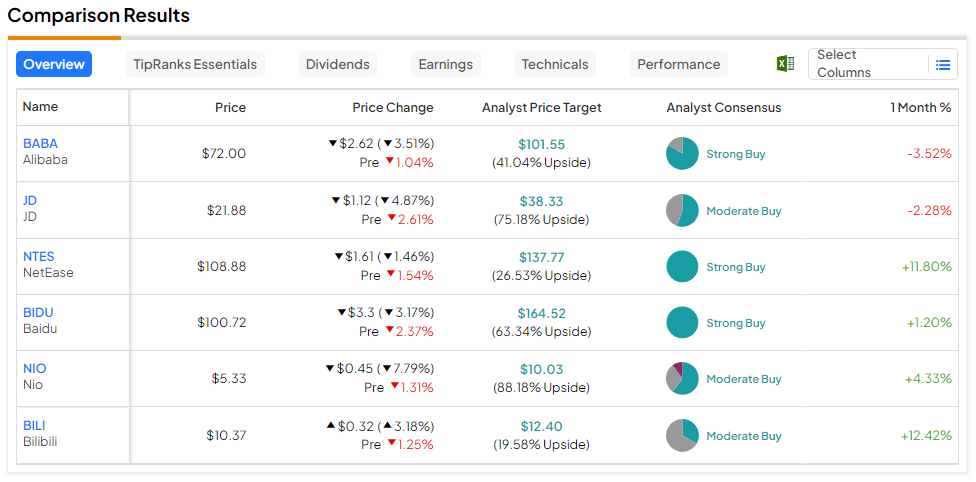

Despite the ambitious GDP growth target, shares of top Chinese names such as Alibaba, Baidu (NASDAQ:BIDU), and NIO (NYSE:NIO) are largely in the red in the early session today. Further, the Direxion Daily FTSE China Bull 3X Shares ETF (YINN) is already down by over 4% at the time of writing. Nevertheless, analysts expect the most upside potential from NIO and JD at 88.2% and 75.2%, respectively.

Read full Disclosure