Chevron Corporation (NYSE: CVX) has delivered upbeat results for the first quarter of 2022, as both earnings and revenue surpassed analysts’ estimates. The solid results were due to the surge in prices of oil and gas.

However, shares of the company slipped 3.1% on Friday to close at $156.67.

The integrated energy company produces crude oil and natural gas, along with manufacturing transportation fuels, lubricants, petrochemicals, and additives.

Results in Detail

Chevron registered adjusted earnings of $3.36 per share, which surpassed the consensus estimate of $3.27 per share. It had reported earnings of $0.9 per share in the same quarter last year.

Additionally, total revenues surged 69.8% on a year-over-year basis to $54.4 billion, outpacing consensus estimates of $47.9 billion.

Segment-wise, both total Upstream and Downstream earnings rose significantly from the prior-year quarter to $6.93 billion and $331 million, respectively. Worldwide quarterly capital and exploration expenditures (C&E) came in at $2.8 billion, up 12% year-over-year.

Global net oil-equivalent production was 3.06 million barrels per day in the quarter. International production decreased 8%, while U.S. production climbed 10% year-over-year.

During the quarter, Chevron produced 692,000 barrels of oil equivalent per day in the Permian Basin. Meanwhile, the company has raised its 2022 guidance to 700,000-750,000 barrels per day, up 15% from 2021.

Stock Rating

Following the results, Wolfe Research analyst Sam Margolin maintained a Buy rating on Chevron and increased the price target to $197 (25.7% upside potential) from $196.

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 14 Buys, eight Holds and one Sell. Chevron’s average price target of $169.96 implies 8.5% upside potential to current levels.

Hedge Fund Trading Activity

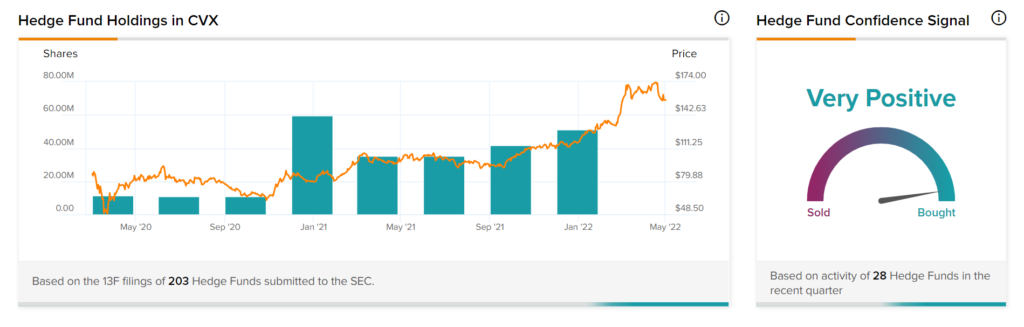

TipRanks’ Hedge Fund Trading Activity tool shows that confidence of hedge funds in Chevron is currently Very Positive, as the cumulative change in holdings across all 28 hedge funds that were active in the last quarter was an increase of 9.7 million shares.

Takeaway

Strong results, positive sentiments of hedge funds and surging oil and gas prices make Chevron look attractive. Further, CVX scores a 9 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to outperform market averages.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Amid Higher Costs & Expenses, Intel Posts Upbeat Q1 Results

Unilever Scathed as Inflation Hits Consumer Goods Sector

Moderna Seeks EUA to Vaccinate Young Children with mRNA-1273