OpenAI’s ChatGPT has led us to experience AI (Artificial Intelligence) firsthand. While AI-based tools like ChatGPT have created a lot of buzz, the bigger question is whether they are safe for widespread use. Raising similar concerns is Apple’s (NASDAQ:AAPL) recent move. Per a Wall Street Journal report, the maker of the iPhone has reportedly delayed the approval for the update of an email app powered by AI tools.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The report highlighted that Apple’s decision to block the update of the email app BlueMail was due to the concerns that the app’s new AI feature could generate content unsuitable for all age groups.

It’s worth noting that BlueMail’s new AI feature leverages ChatGPT’s chatbot to automate emails by using content from previous emails and calendar events.

While Apple has asked BlueMail to increase its age restriction to 17 from four and include content filtering, its recent move indicates the risk these new generative AI tools pose.

Whether these AI tools are safe for widespread use or not remains debatable. But the significant investments made by tech giants like Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) suggest that generative AI is here to stay as it has the potential to become a key growth engine for these companies.

Amid the ChatGPT buzz, let’s look at what analysts recommend for AAPL stock.

What is the Forecast for Apple Stock?

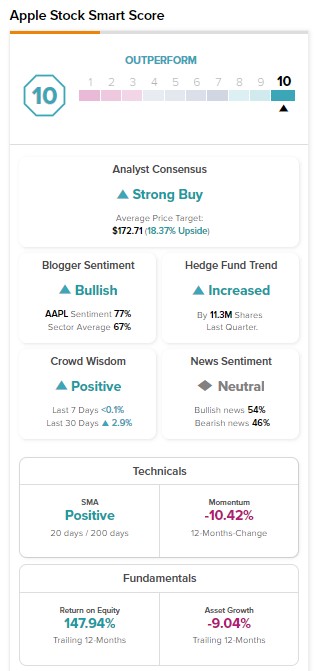

With 25 Buys and five Holds, Apple stock carries a Strong Buy consensus rating on TipRanks. Moreover, these analysts’ average price target of $172.71 suggests 18.37% upside potential. Besides for analysts, hedge funds are also bullish about AAPL stock. Our data shows that hedge funds bought 11.3M shares of AAPL last quarter. Apple stock has a maximum Smart Score of “Perfect 10” on TipRanks.