Celestica (NYSE:CLS) (TSE:CLS) is one of the lesser-known winners of the artificial intelligence (AI) revolution. The Canadian company acts as a behind-the-scenes partner for other electronics businesses, and many of these electronics parts are in high demand because of AI’s developments and rapid expansion. Despite surging 264% over the past 12 months, I’m still bullish on Celestica. The stock has excellent metrics, and the AI revolution is only just beginning.

Celestica’s Transformative Year

For many companies with a finger in the AI pie, 2023 was a transformative year. Of course, AI wasn’t the only reason for Celestica’s success in 2023, but it’s central to the company’s progression over the past 12 months.

So, what does Celestica do? Celestica doesn’t manufacture its own branded products but instead focuses on allowing other companies to bring their electronic requirements to life. The Canadian company offers a one-stop shop for the electronics market, from design to manufacturer to supply chain management.

Part of Celestica’s product offerings includes routers, switches, data center interconnects, edge solutions, and servers/storage-related products. For example, Celestica designs and manufactures the high-performance 800G family of network switches, which are vital for data centers that power AI applications. Celestica also offers storage solutions like the SC6100 controller and SD6200 platform, which provide efficient and scalable data storage for the huge amounts of data AI requires.

The strength of the company’s offering has been reflected in the strength of its earnings growth over the past 12 months. For 2023, Celestica reported non-IFRS adjusted earnings per share (EPS) of $2.43, which was up 28% versus the prior year. Meanwhile, its non-IFRS operating margin of 5.6% was higher year-on-year by 70 basis points. This marked a record 12 months for Celestica both in terms of earnings generated and margins achieved.

Unsurprisingly, Celestica’s Aerospace and Defense (A&D) segment and its Connectivity and Cloud Solutions (CCS) segment performed well. In Q4, A&D experienced growth of more than 20% compared to the prior year period, while CCS saw revenue jump by 10%. However, in the fourth quarter earnings call, the business highlighted the surge in enterprise end-market revenue, up 46% year-over-year, driven by strengthening demand for AI/ML (machine learning) computing.

Moving forward, Celestica is looking to cement its position as an important producer of AI-enabling products. The company is currently building 100,000+ square feet of additional capacity in Thailand, with the first phase expected to be online in the first quarter of 2024. Some of the investment is coming from one of its ‘Hyperscale’ partners. Additionally, Celestica is adding 80,000 square feet of capacity in Malaysia.

Is Celestica Stock Still Cheap?

Companies that surge 264% over the course of a year aren’t often cheap, but Celestica certainly doesn’t look expensive. Core to this, naturally, is rising earnings. Currently, the Canadian firm is trading at 15.3x forward earnings, which is by no means expensive in the current market. Interestingly, and as a side note, Celestica has beaten earnings expectations for each of the quarters all the way back to Q3 2019.

However, growth is central to my investment thesis. The AI revolution is only just beginning, and the development and upkeep of cloud storage solutions and data centers is going to create billions of dollars worth of demand for electrical components and products. Analysts suggest that Celestica’s price-to-earnings ratio will fall to 13.8x in 2025 and then 10.08x in 2026.

These earnings estimates suggest a CAGR of 23% over the next two years. Sadly, these forecasts are too short for us to put together a medium-term price-to-earnings-to-growth ratio.

There’s still some debate concerning the scale of the tailwind that AI presents. However, I see the boom in AI as a long-term opportunity for Celestica, with demand for enabling products only increasing as optimized model training and inference workloads develop.

Is CLS Stock a Buy, According to Analysts?

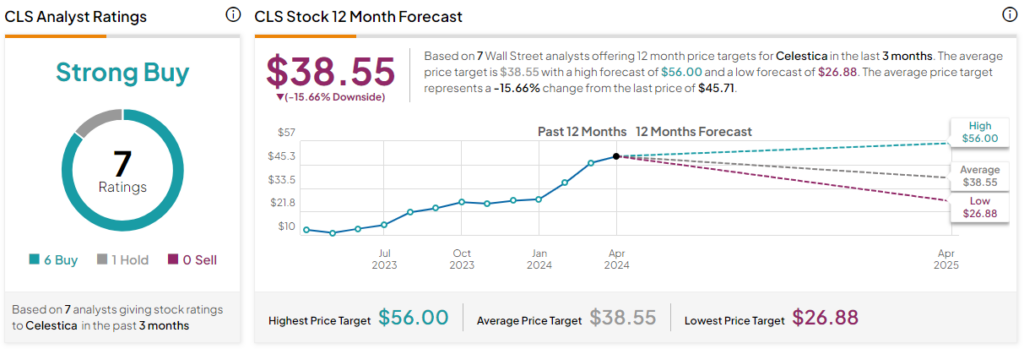

Celestica stock comes in as a Moderate Buy based on 10 Buys, 12 Holds, and three Sells assigned in the past three months. The average CLS stock price target is $38.55, with a high forecast of $56 and a low forecast of $26.88. The average price target represents 15.7% downside potential.

On this occasion, it’s worth highlighting that share price targets are not always updated as frequently as we may like them to be. Sometimes, and this appears to be the case, share price growth can surpass the estimates provided by analysts.

The Bottom Line on Celestica Stock

Wall Street may not be keeping up with Celestica’s meteoric rise, but I remain bullish on this stock, which, in many respects, is an enabler of the quantum leaps we’ve seen in AI. 2023 was a remarkably successful year for the firm, and there’s no reason to expect this growth to slow down in 2024. The company is building on its impressive earnings growth by adding new capacity, and in general, the stock continues to look attractive at just 15.3x forward earnings.