Celestica (NYSE:CLS) shares soared by nearly 7% in the early session today after the supply chain solutions provider delivered a better-than-expected performance for the fourth quarter. Revenue increased by nearly 5% year-over-year to $2.14 billion, exceeding estimates by $60 million. Similarly, EPS of $0.76 outperformed expectations by $0.08.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For the full year, revenue increased by 10%, and non-IFRS adjusted EPS came in at a record $2.43. In Q4, CCS (Connectivity & Cloud Solutions) segment revenue rose by 10%. In contrast, revenue in the ATS (Advanced Technology Solutions) segment dropped by 2%.

Still, Rob Mionis, the President and CEO of Celestica, expects the robust momentum from 2023 to continue into 2024. For the upcoming quarter, Celestica expects revenue to be in the range of $2.025 billion to $2.175 billion. Non-IFRS adjusted EPS for the quarter is seen landing between $0.67 and $0.77.

Moreover, Celestica has raised its adjusted free cash flow outlook for Fiscal Year 2024 to at least $200 million from the prior estimate of at least $175 million.

Is Celestica a Good Stock to Buy?

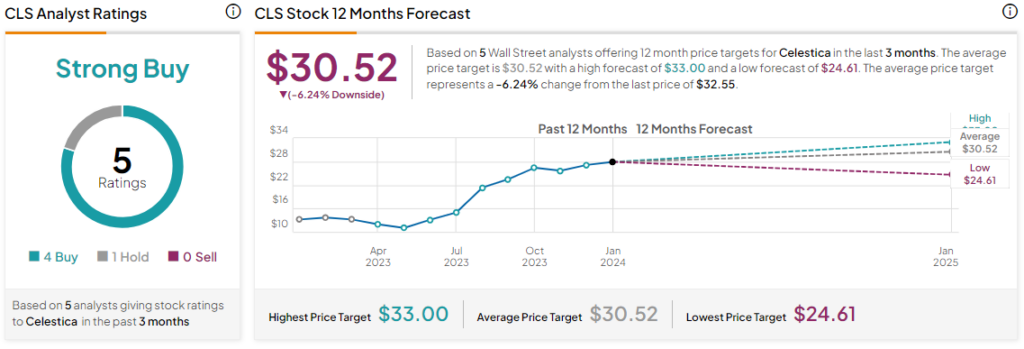

Overall, the Street has a Strong Buy consensus rating on Celestica. Following a mega 156% rally in the company’s share price over the past year, the average CLS price target of $30.52 implies a potential downside of 6.2% in the stock.

Read full Disclosure