It’s no longer just a summer camp prank; it’s time to salute the shorts. Particularly, the Carvana (NYSE:CVNA) shorts, who are now feeling intense pressure as Carvana surges once more, up over 17% at one point in Friday afternoon’s trading. So what’s got Carvana investors so enthusiastic? Some positive news is helping, but maybe, it’s just another stab to the short-seller.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The long and the short of things at Carvana aren’t good. As one analyst noted, Carvana’s profitability is minimal, if there at all, and Carvana carries a massive debt load. It also doesn’t help matters much that the used car market is struggling right now. With soaring interest rates, and car payments on the rise too—a record number of car buyers now have payments over $1,000 per month, according to an Edmunds study—that makes Carvana somewhat unattractive to at least some investors. Car buyers are paying higher APRs than any time since the 2008 financial crisis, and they’re paying more outright as well.

However, there were signs that suggested positive developments could be ahead for Carvana, and even offered some rationale for climbing share prices. Last month, Carvana revealed that it expected its adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) to come in above $50 million in the second quarter. Further, as one analyst noted, any piece of good news, at this point, could be enough to trigger a serious upswing for Carvana.

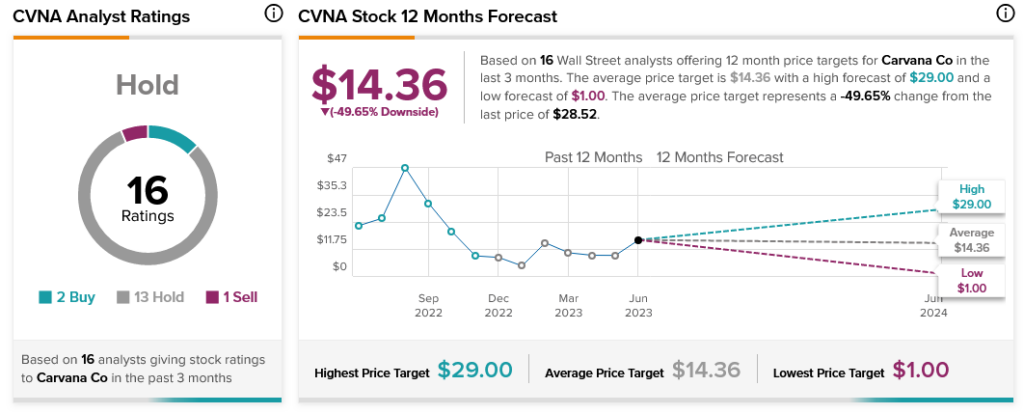

That’s actually in line with larger analyst opinion. With 13 Hold ratings, two Buys and one Sell, Carvana is overwhelmingly a Hold right now by analyst consensus. However, with an average price target of $14.36, Carvana stock also comes with a hefty 49.65% downside risk.