Bank of America remains somewhat skeptical about Carvana stock (NYSE:CVNA), as its impressive rally didn’t sway equity analyst Nat Schindler, who decided to move from a previous Neutral rating to No Rating on the stock. He admits the positive forecast change is a good sign but strongly advises a cautious approach due to the stock’s unpredictable path. Furthermore, he underlines the need for Carvana to address its hefty debt issue, a task that would require far-reaching solutions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Schindler also drew attention to Carvana’s financial health, warning, “Without a lifeline of cash, Carvana may very well deplete its accessible and affordable cash reserves by 2023’s close.” He did not rule out the chance of a cash injection but conceded that its timing and occurrence were unpredictable. Adding to this mix is the high short interest. This cocktail of factors, in Schindler’s perspective, will result in a binary outcome for the stock. The stock’s trading patterns, he believes, reflect more of the company’s balance sheet and liquidity than its actual core business performance.

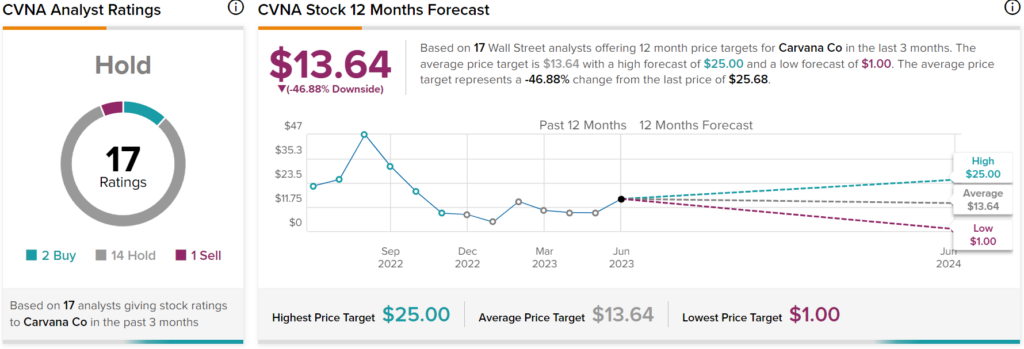

Overall, Wall Street analysts have a consensus price target of $13.64 on CVNA stock, implying 46.88% downside potential, as indicated by the graphic above.