Shares of Cano Health (NYSE: CANO) plunged by more than 18% in pre-market trading on Thursday after the value-based primary care provider and population health company’s FY23 guidance trailed estimates. The company expects total revenue in the range of $3.10 billion to $3.25 billion falling short of consensus estimates of $3.29 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cano anticipates ending FY23 with memberships in the range of 375,000 to 385,000 with adjusted EBITDA expected to be between $75 million and $85 million.

The company’s losses widened in the fourth quarter to $0.61 per share versus a loss of $0.12 in the same period last year and were more than analysts’ consensus estimate of $0.12 per share.

Sales increased by 40.2% year-over-year to $680.4 million and surpassing analysts’ expectations of $654.5 million.

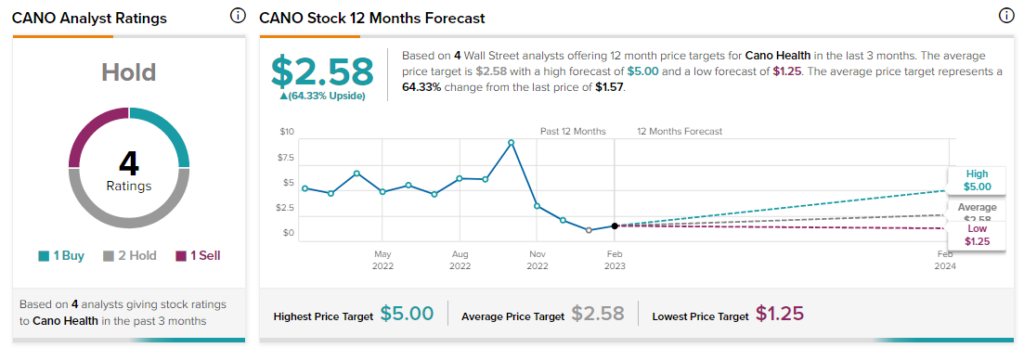

Overall, Wall Street analysts are sidelined about CANO stock with a Hold consensus rating based on one Buy, two Holds, and one Sell.