Burberry Group (GB:BRBY) issued its first-quarter trading update for the three months ending July 2, 2022, and the company’s sales have been badly affected by COVID-19 lockdowns in China.

The company’s comparable store sales increased by 1% as they were badly impacted by multiple lockdowns in China – although numbers in Europe saw a boost from the return of American tourists, with EMEIA store sales growing 47%.

In the US, sales fell by 4% and in Asia-Pacific numbers were down by 16%.

Major categories such as leather goods and outerwear posted double-digit comparable growth outside of China. Leather goods sales grew by 21%, led by the Lola handbag range.

A troubled three years for Burberry

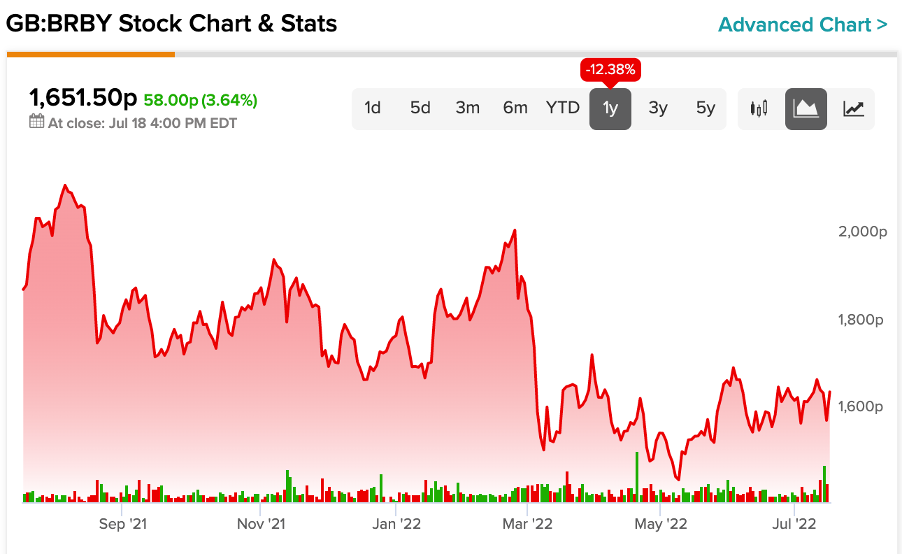

The stock is trading down by 24.4% over the past three years.

In March 2022, the stock fell by 500 points. The downfall is attributed to various factors, such as the Russia-Ukraine war, which led to its stores’ closure in Russia. Rising commodity prices and a slowdown in consumer spending also led to negative sentiment from investors.

Big trouble in China

Burberry’s sales were down by 35% in China. The company generates the majority of its revenue from Asia, mainly from China.

Sophie Lund-Yates, an analyst at Hargreaves Lansdown, commented:“Burberry’s first quarter performance has sorely disappointed the market, with concerns around lacklustre growth. Mainland China is acting as a serious drag, overshadowing successes elsewhere. The group’s medium-term ambitions for revenue growth are admirable, but exactly how this will be achieved is the big question for CEO Jonathan Akeroyd.”

As the stores in China reopened in June 2022, the company expects high-single-digit growth and 20% margins in the medium term.

Moreover, the company is committed to its plans to invest in its brand and products with an increased focus on digital, metaverse, and NFT collections.

View from the City

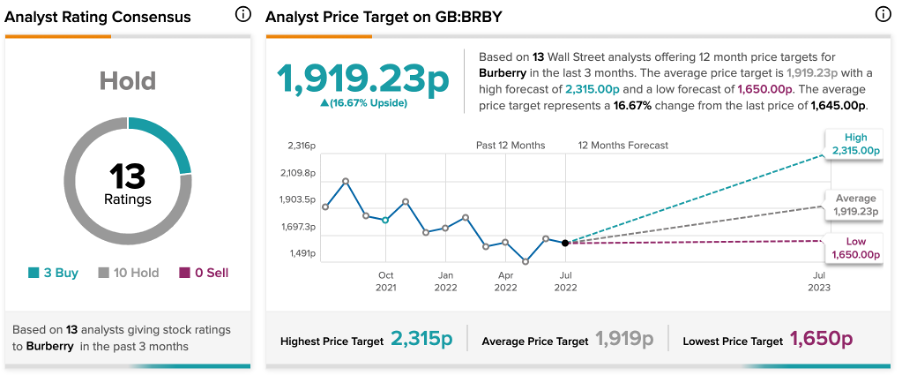

According to TipRanks’ analyst rating consensus, Burberry stock has a Hold rating. The stock has ratings from a total of 13 analysts, including 10 Hold and three buy recommendations.

Burberry’s average price target is 1,919.23p, which implies a 16.7% upside potential from the current price level. The stock has a high forecast of 2,315p and a low forecast of 1,650p.

Conclusion

Burberry shares come with a good income for investors. The company’s dividend yield, at 2.96% is higher than the sector average of 1.65%.

As China remains a key market for the company, the short-term challenges will remain. Retail sales in China are expected to recover in the coming months.

Overall, the company is in a position to push its sales and profits in the long term.