Broadcom Inc. (AVGO) reported stronger-than-expected fiscal Q3 results, topping both earnings and revenue estimates driven by robust performances across all segments and end markets.

Shares of the U.S.-based designer, manufacturer, and global supplier of a wide range of semiconductor and infrastructure software products, have gained around 40% over the past year. (See Broadcom stock charts on TipRanks)

Adjusted earnings of $6.96 per share beat analysts’ expectations of $6.85 per share. The company reported earnings of $5.40 per share in the prior-year period.

Further, revenues jumped 16% year-over-year to $6.78 billion and exceeded consensus estimates of $6.74 billion. The increase in revenues reflected a surge in Semiconductor solutions revenues, which increased 74% to $5 billion, and 26% growth in Infrastructure software revenues to $1.8 billion.

Markedly, the company recorded a strong adjusted EBITDA margin of 61% during the quarter.

Broadcom CEO Hock Tan commented, “Broadcom delivered record revenues in the third quarter reflecting our product and technology leadership across multiple secular growth markets in cloud, 5G infrastructure, broadband, and wireless.”

Looking ahead, he further added, “We are projecting the momentum to continue in the fourth quarter.”

Based on robust Q3 results and business trends, management provided financial guidance for the fourth quarter of Fiscal 2021. The company forecasts revenues of $7.35 billion, ahead of the consensus estimate of $7.23 billion.

Further, the company expects an adjusted EBITDA margin of 61% for the fourth quarter.

Following the upbeat Q3 results, KeyBanc analyst John Vinh increased the price target on Broadcom from $565 to $575 (16.9% upside potential) and maintained a Buy rating.

Vinh was impressed by the robust improvement in enterprise demand, which represents 50% of semiconductor revenue.

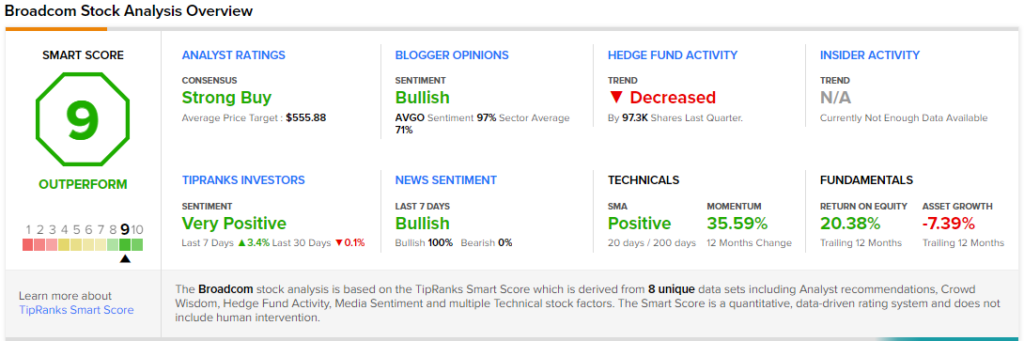

Consensus among analysts is a Strong Buy based on 17 Buys and 2 Holds. The average Broadcom price target of $555.88 implies 13% upside potential to current levels.

AVGO scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

ChargePoint Posts Q2 Revenue Beat and Raises Guidance; Shares Gain 13%

Semtech Beats Q2 Earnings Expectations; Shares Rise 4%

Phreesia Reports Mixed Q2 Results, Raises Revenues Guidance