Semtech Corporation (SMTC) shares jumped 4% in Wednesday’s extended trading session after the company delivered better-than-expected fiscal second-quarter results. It also provided Q3 sales guidance.

The quarterly beat was attributable to robust global demand for Semtech’s core growth engines in the IoT and Infrastructure segments, primarily driven by the LoRa and Tri-Edge platforms.

Shares of the supplier of analog and mixed-signal semiconductors and advanced algorithms have gained around 17% over the past year. (See Semtech stock charts on TipRanks)

Adjusted earnings of $0.65 per share beat analysts’ expectations of $0.62 per share. The company reported earnings of $0.43 per share in the prior-year period.

Furthermore, net sales jumped 29% year-over-year to $185 million and exceeded consensus estimates of $182.55 million. The increase in revenues reflected a surge in wireless and sensing product group net sales, driven by LoRa, as well as growth in signal integrity product group net sales, driven by record Tri-Edge sales.

On top of this, the adjusted gross margin grew 90 bps year-over-year to 62.7%, aided by the increase of new products.

Looking ahead, the company provided guidance for the third quarter of Fiscal 2022. The company forecasts net sales in the range of $188 – $198 million, while the consensus estimate is pegged at $189 million.

Additionally, adjusted earnings are forecast to be in the range of $0.68 to $0.76 per share, while gross margin is expected to range between 62.8% and 63.8%.

Semtech CEO Mohan Maheswaran commented, “We are confident that we should be able to continue to execute across all our product groups and deliver a record performance in FY2022.”

Ahead of the earnings announcement, Piper Sandler analyst Harsh Kumar reiterated a Buy rating on the stock with a price target of $84 (18.4% upside potential)

Kumar remained confident that Semtech will post “beat and raise” quarterly results. He added that Semtech shares exhibit a “solid risk-reward dynamic,” as they have underperformed year-to-date.

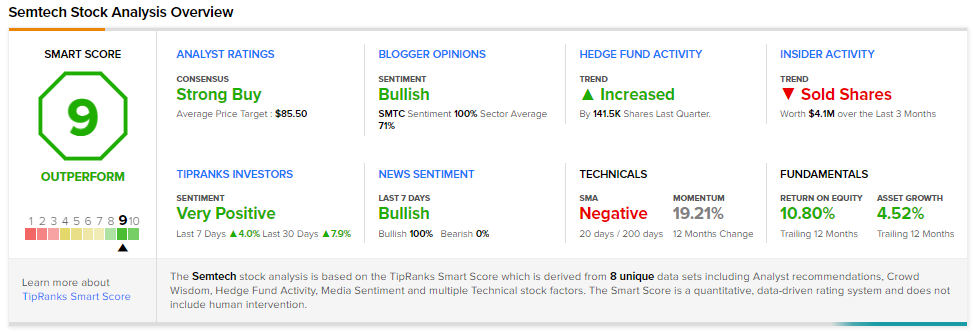

Consensus among analysts is a Strong Buy based on 8 Buys and 1 Hold. The average Semtech price target of $85.50 implies 20.5% upside potential to current levels.

SMTC scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Futu Holdings Reports Strong Q2 Results, Several Milestones Achieved

NIO Lowers Third Quarter Delivery Outlook; Shares Plunge 4%

Walmart Plans to Hire 20,000 New Supply Chain Associates