BridgeBio Pharma Inc (BBIO), through its affiliates QED Therapeutics Inc. and Helsinn Group, announced that they have received the U.S. Food and Drug Administration’s (FDA) accelerated approval for TRUSELTIQ (infigratinib), an orally administered, ATP-competitive, tyrosine kinase inhibitor of FGFR. Shares of the company were up 2.1% to close at $59.20 on May 28.

This new oral drug is designed to treat patients with previously-treated locally advanced or metastatic cholangiocarcinoma (CCA) harboring an FGFR2 fusion or rearrangement. Furthermore, advanced trials have shown that TRUSELTIQ led to cases of tumor shrinkage.

The companies indicated that the U.S. regulator’s decision was based on data from the Phase 2 clinical study, which demonstrated the efficacy and safety of the treatment. The phase 2 study included 108 patients with advanced cholangiocarcinoma, all of whom had received at least one prior line of systemic therapy.

Per the terms of the agreement, BridgeBio and Helsinn Therapeutics (U.S.) will jointly commercialize TRUSELTIQ in the U.S., with equal profit and loss sharing.

QED’s M.D., M.S.C.E., Chief Medical Officer Susan Moran said, “This is an important milestone for patients diagnosed with FGFR2-fusion-driven cholangiocarcinoma who have recurred after first-line therapy and are in need of targeted options for further treatment.”

Susan further added, “Based on the efficacy seen to date, our team believes infigratinib possesses promise for a range of FGFR-driven conditions, including other cancers. We will continue to evaluate its safety and efficacy in these areas of unmet need.” (See BridgeBio Pharma stock analysis on TipRanks)

On May 28, Mizuho Securities analyst Salim Syed reiterated a Buy rating and a price target of $86 (45.3% upside potential) on the stock.

Syed said, “The approval is not a major stock driver (i.e. small indication), but strategically, this drug is now BridgeBio’s first drug approval in oncology and second this year, hence another push toward commercial integration. For those in the weeds and following the CCA market, what is interesting here are the pricing dynamics between Truseltiq and Incyte’s Pemazyre.”

The analyst added, “Truseltiq will be available in US in about 2 weeks, and expects single-digits $MM revenue for 2021 given that it will capture only the last two quarters of the year essentially, and it is second to market vs Pemazyre.”

Consensus among analysts is a Strong Buy based on 8 unanimous Buys. The average analyst price target stands at $82 and implies upside potential of 38.5% to current levels. Shares have gained almost 105% over the past year.

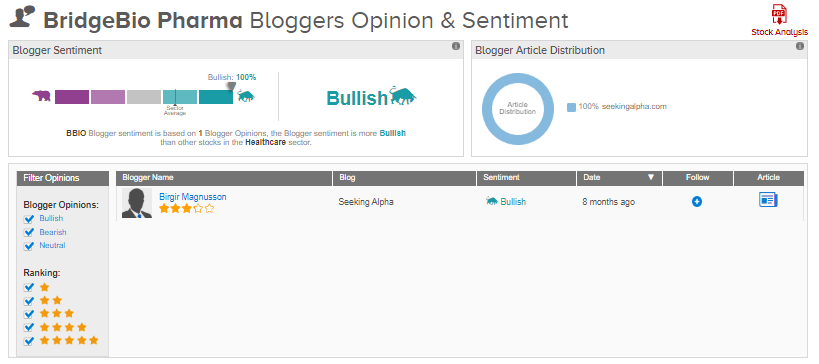

TipRanks data shows that financial blogger opinions are 100% Bullish on BridgeBio, compared to a sector average of 68%.

Related News:

Westport to Snap up Stako for €5M; Street Says Buy

Black Knight Inks $250M Deal with Top of Mind Networks, Drive Marketing Automation

LyondellBasell Bumps up Quarterly Dividend by 7.6%