BP PLC (BP) said it expects to incur up to $17.5 billion in non-cash impairment charges and write-offs in the second quarter, as the enduring impact of the coronavirus pandemic on the global economy is poised to lead to weaker energy demand for a sustained period.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares fell 5.6% to $23.36 in Monday’s pre-market trading.

The charge, which is estimated to be in an aggregate range of $13 billion to $17.5 billion post-tax, comes after BP lowered its investment appraisal long-term price assumptions by an average of about 30% and extended the period covered to 2050.

The revised long-term price assumptions are now for an average of around $55/bbl for Brent and $2.90 per mmBtu for Henry Hub gas ($2020 real), from 2021-2050.

In addition, the oil magnate expects that the pandemic’s aftermath will accelerate the pace of transition to a lower carbon economy and energy system, as countries seek to “build back better” so that their economies will be more resilient in the future. As part of its long-term strategic planning, BP is also considering, the development of some of its exploration intangible assets.

“In February we set out to become a net zero company by 2050 or sooner,” said BP CEO Bernard Looney. “Since then we have been in action, developing our strategy to become a more diversified, resilient and lower carbon company.”

“All that will result in a significant charge in our upcoming results, but I am confident that these difficult decisions – rooted in our net zero ambition and reaffirmed by the pandemic – will better enable us to compete through the energy transition,” he added.

Second-quarter results are expected to be released on August 4th.

Shares in BP have lost 34% of their value this year as the coronavirus pandemic pushed oil prices to multi-year lows leading to declines in oil and gas output. The stock advanced 2.8% to $24.75 at Friday’s close.

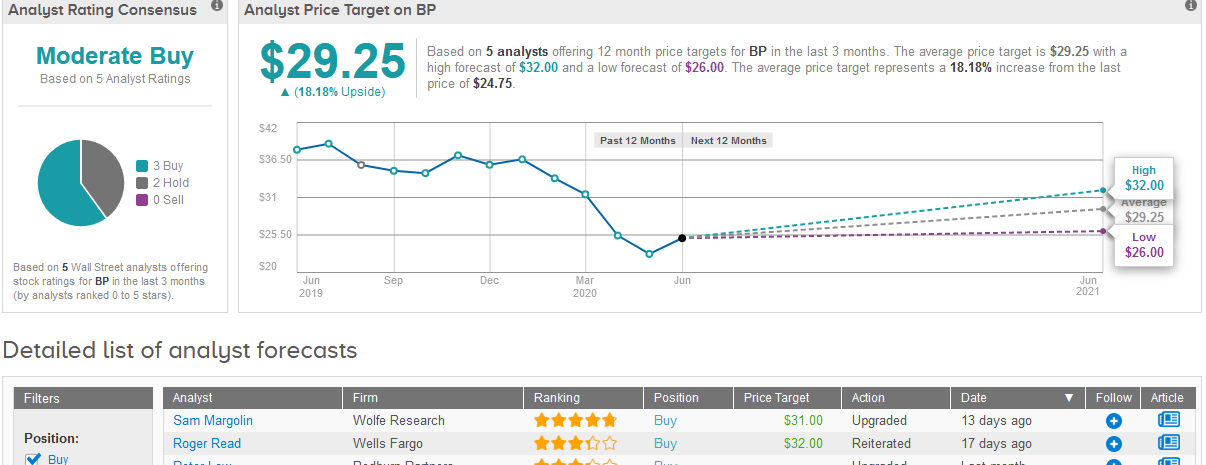

Meanwhile, five-star analyst Sam Margolin at Wolfe Research earlier this month raised BP’s rating to Buy from Hold with a price target of $31, up from $29, saying that the company has “a credible pathway” to deleveraging and dividend coverage in 2021.

Overall, Wall Street analysts have a cautiously optimistic outlook on BP. The stock’s Moderate Buy consensus splits into 3 Buy ratings versus 2 Hold ratings. The $29.25 average price target implies a potential 18% gain in the shares over the coming 12 months. (See BP stock analysis on TipRanks).

Related News:

Extraction Oil & Gas Files For Bankruptcy; Announces $125M Funding Plan

2 Dividend Stocks Yielding More Than 5%; RBC Says ‘Buy’

RWE, Thyssenkrupp Plan Hydrogen Production Partnership – Report