Booking Holdings (NASDAQ:BKNG) posted strong Q4 results. The company also took advantage of its record free cash flow to enhance shareholder returns, including announcing its first-ever dividend. Shares dipped post-earnings, likely due to an overreaction about Booking’s prospects in the Middle East amid the ongoing unrest. That said, the potential impact appears negligible overall. Further, the start of a dividend should expand Booking’s shareholder base. For these reasons, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Strong Q4 Results Fueled by a Vibrant Travel Industry

Booking’s Q4 results, contrary to Wall Street’s post-earnings sell-off reaction, actually showed significant strength. The numbers underscored a vibrant travel industry that has continued to improve consistently following the post-COVID revenge travel trend.

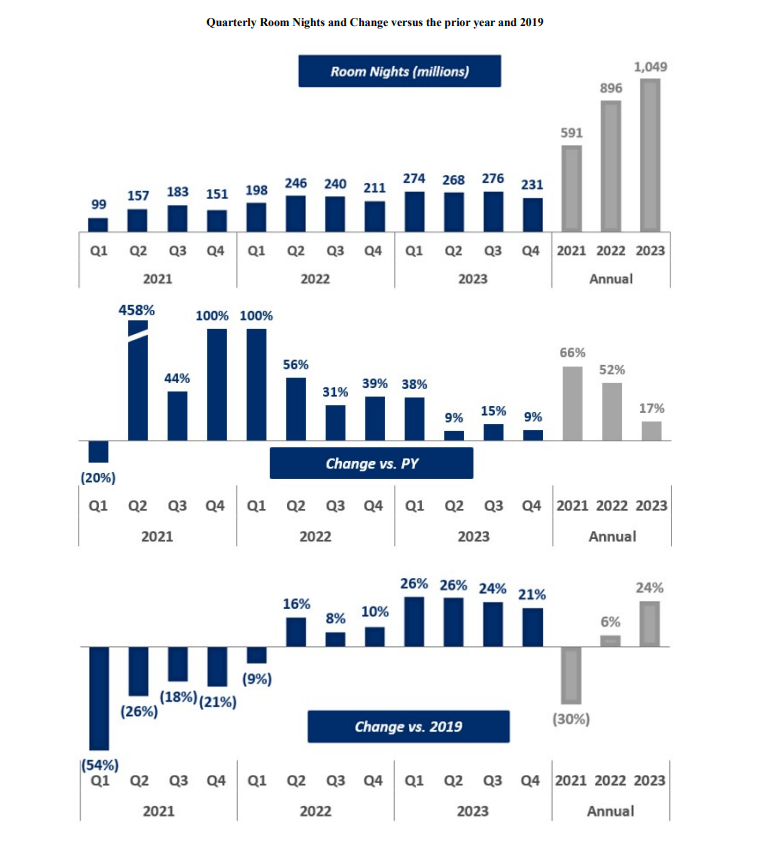

Revenues grew by 18% to $4.78 billion in Q4, exceeding Wall Street’s expectation by $70 million. Revenue growth was mainly powered by room nights for the period, increasing 9% year-over-year and 21% versus 2019. The latter figure not only showcases the company’s impressive post-COVID recovery trajectory but also shows that with sustained momentum, room nights have now expanded notably beyond their prior 2019 benchmark levels.

Booking’s strong Q4 results contributed to the company ending FY2023 on a high note, including record room nights of 1.05 billion, up 17% year-over-year and 24% from FY2019, and record revenues of $21.4 billion, up 25% year-over-year, and 41.7% from 2019.

Record Revenues, Lean Business Model Drive Record Free Cash Flow

With Booking posting record revenues while taking advantage of its lean business model, the company was able to post record free cash flow.

Specifically, Booking’s asset-light approach allows the company to harness the ongoing tailwinds in the travel industry, all without the burden of owning hotels, restaurants, or car fleets featured on its platforms. Thus, its model enables the company to leverage revenue growth to deliver surging free cash flow.

Adding to this, Booking restructured its business in the past couple of years by reducing its workforce, while CapEx also declined year-over-year. These moves paid off in FY2023, as Booking’s free cash flow surged to $7 billion billion for the period, marking a new record. To put it in perspective, last year saw $6.2 billion in free cash flow, and before the pandemic, in FY2019, it was at a much lower $4.5 billion.

Capacity for Further Shareholder Rewards, Dividend Initiated

With Booking reporting an all-time-high free cash flow, its capacity for shareholder returns grew notably. The company, therefore, besides repurchasing a record $10.4 billion worth of stock during the year, also announced its first-ever dividend. I was quite surprised by this move, as Booking had exclusively utilized share repurchases for returning cash to shareholders for more than two decades up until now. However, it was certainly a pleasant surprise, as a dividend should help expand the company’s shareholder base.

While the $8.75 quarterly dividend currently translates to a yield of just 1%, dividend growth investors, for instance, who would previously not buy Booking due to lacking a dividend, will now be encouraged to reconsider the stock. But this goes beyond individual investors. Specifically, dividend ETFs and fund managers who would previously require a company to pay a dividend to hold it will now be able to purchase Booking stock.

Thus, besides initiating a dividend coming with several benefits, such as increased liquidity, better market coverage, and tangible capital returns hitting shareholders’ accounts, there is also a chance that the stock undergoes a valuation expansion as its shareholder base expands.

This possibility of a valuation expansion, combined with Booking posting excellent results in FY2023, should fuel the stock’s bullish sentiment moving forward, in my view.

So, Why Did Shares Dip Following Booking’s Q4 Results?

Given the numbers just discussed, including record revenues, free cash flows, and capital returns, it was rather strange to see shares dip following Booking’s Q4 results. In my view, the dip can be attributed to the market’s concerns regarding the company’s performance in the Middle East. The ongoing conflict in the region and the instability arising from it have hurt the traveling industry on the border continent.

In particular, Booking’s cancellation rates in Q4 were slightly higher compared to last year. Additionally, management expects that the ongoing war in the Middle East will have a “negative 1% impact” on Q1 room night growth.

That said, I believe the stock’s post-earnings sell-off was an overreaction. When considering Booking’s global operations, this impact appears negligible. Clearly, with Q4 results showing significant growth in the midst of this conflict, I would argue that there is little cause for concern. Booking is as geographically diversified as it gets, so it is pretty much insulated from a regional yet sad and devastating conflict.

Is BKNG Stock a Buy, According to Analysts?

Turning to Wall Street, Booking Holdings has a Moderate Buy consensus rating based on 17 Buys and eight Holds assigned in the past three months. At $3,957.39, the average Booking Holdings stock price target suggests 13.8% upside potential over the next 12 months.

If you’re wondering which analyst you should follow if you want to buy and sell BKNG stock, the most accurate analyst covering the stock (on a one-year timeframe) is Mark Mahaney of Evercore ISI, with an average return of 29.40% per rating and an 83% success rate. Click on the image below to learn more.

Conclusion

Overall, I would say that Booking Q4 and full-year results were excellent. The company continues to ride on the post-pandemic craze the travel industry is experiencing, posting record revenues, free cash flow, and share repurchases. The initiation of a dividend was the cherry on top, as it has the potential to grow both shareholder returns and the overall shareholder base, which should eventually benefit the stock.

Considering these developments, Booking’s post-earnings sell-off presents an opportunity to take advantage of, in my view.